To sign up to receive the latest Canadian Energy Centre research to your inbox email: [email protected]

Download the PDF here

Download the charts here

Overview

There has been a lot of discussion in the media about the Michigan governor, Gretchen Whitmer, and her attempts to end operations for Enbridge Line 5, the pipeline that winds its way between Superior, Wisconsin, and Sarnia, Ontario. The pipeline carries products that fuel the region’s industries and communities: light oil, synthetic light oil, and natural gas liquids (NGLs), much of which is refined into propane.

Enbridge has applied to state regulators in Michigan and federal regulators in Canada for permission to commence a $500-million project to make Line 5 even safer, enabling continued reliable energy delivery while boosting employment in the region.

While there has been much attention paid to the fate of Line 5 itself, there has been little analysis of the strong links between Michigan and Canada when it comes to energy, most notably energy trade (exports and imports), and the economic impact of the pipeline transportation sector in Michigan.

Energy trade flows between Michigan and Canada

According to the US Energy Information Administration (EIA),

Several interstate pipelines cross Michigan and there are also five U.S.-Canadian natural gas pipeline crossings…Natural gas enters Michigan from Ohio, Indiana, and Wisconsin, and, although Michigan receives a small amount of pipeline natural gas from Canada, the bulk of the natural gas flowing across the border goes into Canada, most of it at St. Clair. More natural gas enters the state than is consumed there and most of the excess is exported to Canada.

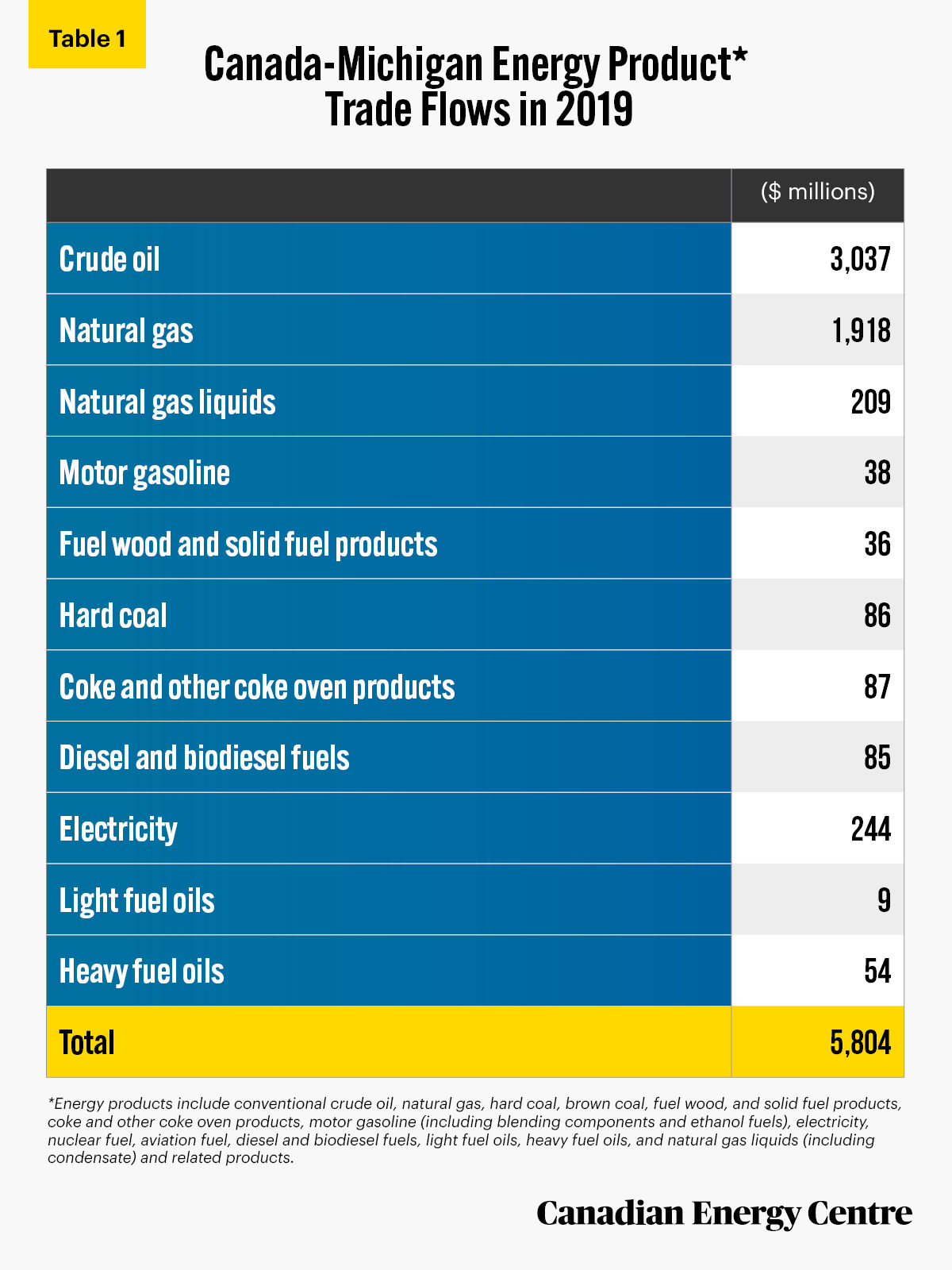

In 2019, the total value of value of energy product trade flows between Canada and Michigan was over CA$5.8 billion or US$4.4 billion (see Table 1).

Source: Statistics Canada, International Accounts and Trade Division (2021a and 20201b).

Michigan’s $1.6 billion in energy exports to Canada

The total value of energy products imported into Canada from Michigan was nearly $1.6 billion in 2019. This includes:

- Nearly $1.5 billion in natural gas;

- $11.7 million in natural gas liquids (including condensate) and related products;

- $3.5 million in hard coal;

- $82.3 million in coke and other coke oven products ;

- $7.9 million in motor gasoline; and

- $11.5 million in diesel and other biofuels (Statistics Canada, 2021a).

Canada’s $4.2 billion in energy exports to Michigan

The total value of energy products exported from Canada to Michigan was over $4.2 billion in 2019. This includes:

- $3.0 billion in conventional crude oil;

- $458.9 million in natural gas;

- $244.3 million in electricity;

- $197.5 million in natural gas liquids (including condensate) and related products;

- $82.2 million in hard coal;

- $4.9 million in coke and other coke oven products;

- $73.9 million in diesel and biodiesel fuels;

- $54.4 million in heavy fuel oils;

- $9 million in light fuel oils;

- $36.1 million in fuel wood and solid fuel products; and

- $30.3 million in motor gasoline (Statistics Canada, 2021b).

Economic impact of pipeline transportation on the Michigan economy

The pipeline transportation sector¹ has a significant impact on Michigan’s economy. It

- employed 1,430 people as of 2019, according to the U.S. Bureau of Labour Statistics; and

- made a contribution of over US$643 million to the Michigan economy in 2019, according to the U.S. Bureau of Economic Analysis.

Key labour income statistics

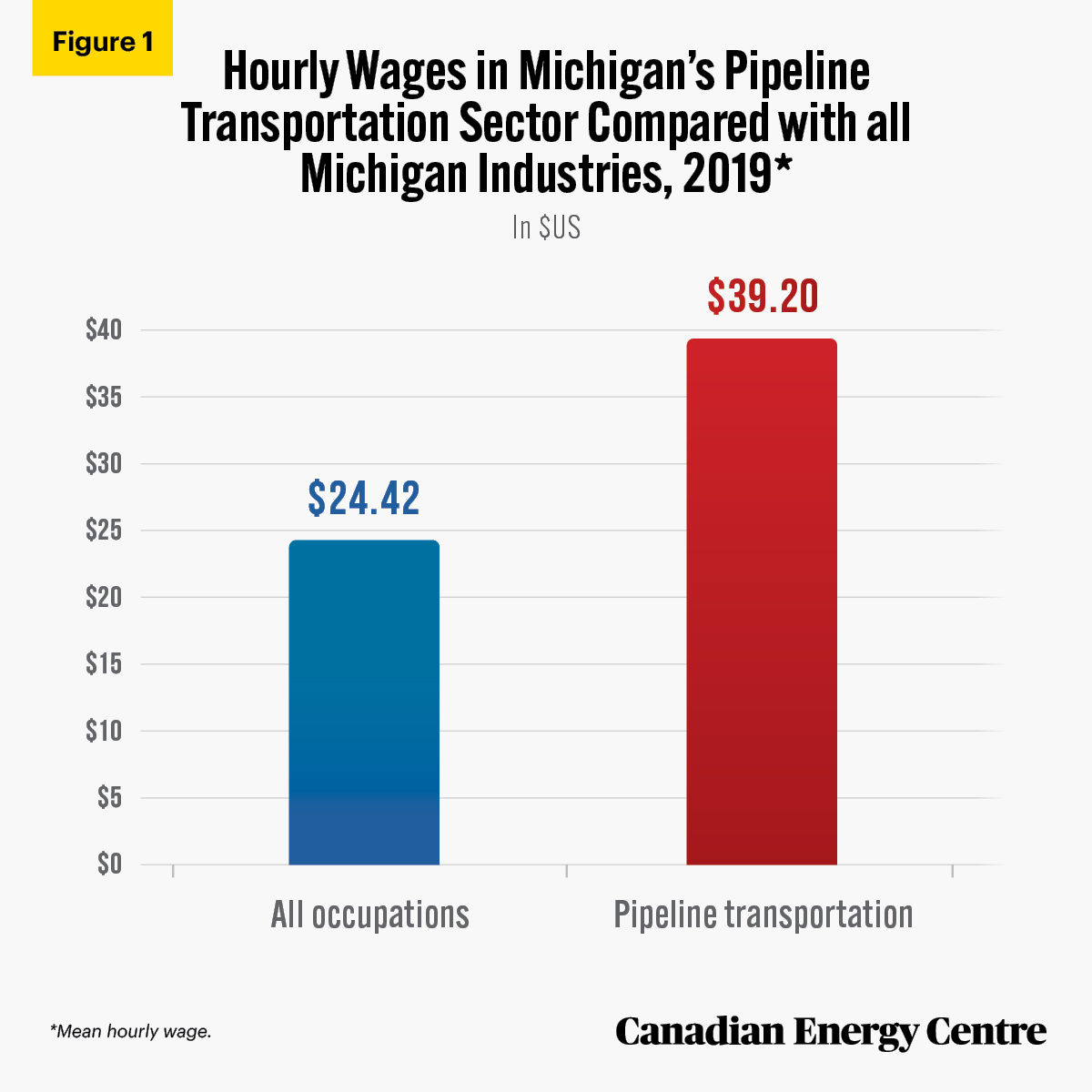

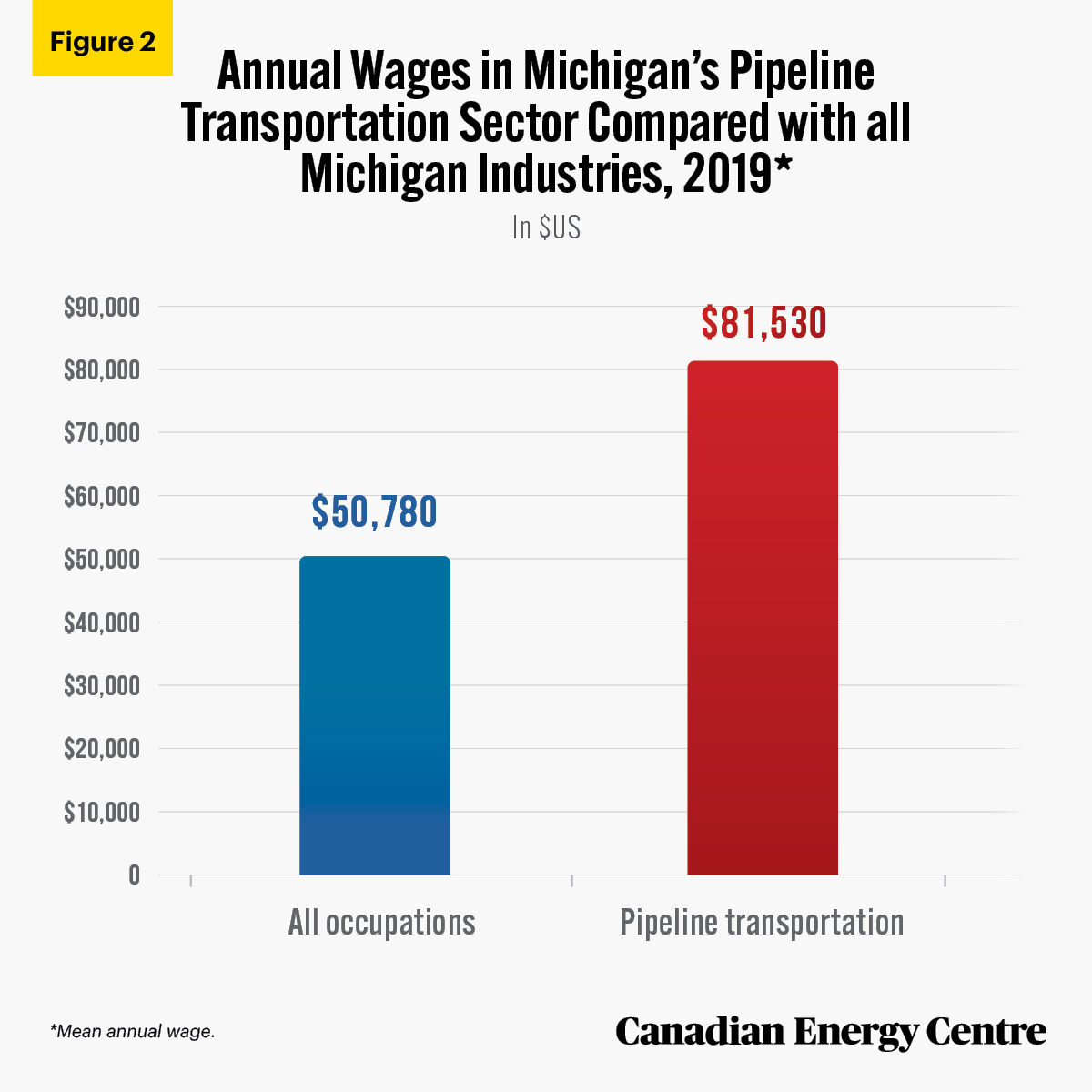

According to the U.S. Bureau of Labour Statistics, as of May 2019, the mean wage² for those employed in the pipeline transportation sector in Michigan was $39.20 per hour, 61 per cent higher than the mean wage for all occupations in Michigan, at $24.42. Similarly, the annual mean wage in the pipeline transportation sector was $81,530, also 61 per cent higher than the $50,780 annual mean wage for all occupations (see Figures 1 and 2)

1. Industries in the pipeline transportation subsector use transmission pipelines to transport products, such as crude oil, natural gas, refined petroleum products, and slurry. Industries are identified based on the products transported (i.e., pipeline transportation of crude oil, natural gas, refined petroleum products, and other products). 2. Annual wages have been calculated by multiplying the hourly mean wage by a “year-round, full-time” figure of 2,080 hours; for those occupations where there is no published hourly wage, the annual wage has been directly calculated from the reported survey data

Source: U.S. Bureau of Labor Statistics (2020).

Source: U.S. Bureau of Labor Statistics (2020).

Some key facts on Line 5 and its impact on Michigan, Ontario, and Quebec

Shutting down Line 5 would have adverse impacts on the economies of Michigan, Ontario, and Quebec.

Estimates indicate that an average workforce of 200 to 255 people will be required during the construction stage of the Line 5 project; when construction is at its busiest, the workforce will peak at an estimated 300 to 325 workers. The yearly wage for these workers is estimated to range from $60,000 to $200,000. These benefits would be lost if Line 5 were shut down.

Line 5 transports up to 540,000 barrels per day (bpd) of light crude oil, light synthetic crude, and natural gas liquids (NGLs), much of which is refined into propane.

- This includes 432,000 bpd of crude oil and 108,000 bpd of natural gas liquids.

- Of the 432,000 bpd of light crude oil, about 70 per cent, or 302,400 bpd, along with nearly all of the natural gas liquids, go straight through Michigan and across the St. Clair River to Sarnia, Ontario.

- Those 302,400 daily barrels of oil are refined into propane, and then returned directly to Michigan for consumption and storage.

If Line 5 were shut down,

- Refineries in Michigan, Ohio, Pennsylvania, Ontario, and Quebec, all served by Enbridge, would receive just 14.7 million US gallons of energy products per day, or about 45 per cent less from Enbridge than their current supply of gas, diesel, and jet fuel.

- Michigan alone would face a propane supply shortage of 756,000 US gallons per day, or 55 per cent of current supply, since there are no short-term alternatives for transporting natural gas liquids to market.

Shutting down Line 5 would have serious implications for residents of Ontario and Quebec, too:

- Line 5 transports 540,000 bpd of oil and natural gas liquids into the Sarnia area (about half of the pipeline capacity to Ontario).

- If the line were shut down, distribution points in southern Ontario would face shortfalls of gasoline, diesel, and jet fuel.

- Quebec could also be affected by rising prices in the area. Specifically, commuters and commercial transport could see higher gasoline prices.

Here’s what Michigan’s energy sector and economy would look like without Line 5:

- Michigan would need to find an alternative supply for between 4.2 million and 7.8 million US gallons of refined products (gas, diesel, jet fuel, and propane) every day.

- Line 5 provides 55% of the state’s propane needs and there are no alternatives if Line 5 shuts down.

- Currently, there are no viable options for replacing the volume of light crude that Line 5 delivers; rail can only deliver less than 10 per cent of that volume.

- Half of the aviation fuel at Detroit International Airport comes from Line 5 via a Toledo refinery; if Line 5 shuts down, the Toledo refinery shuts down as well with airline traffic disruption at Detroit International and lost jobs.

- It would take an estimated 2,100 trucks heading east every day from Superior, and travelling across Michigan, to do the same job.

- Similarly, it would take 800 rail cars a day to transport the equivalent amount of product. Using rail would increase the cost of propane by between $0.10 and $0.35 per gallon, depending on the supply location. Some of these costs would be passed on to customers.

- The infrastructure does not currently exist to support the necessary truck or rail traffic to fill the job currently done by Line 5.

Shutting down Line 5 will have impacts on home heating costs in Michigan:

- According to the investment research firm YCharts, the Michigan residential propane price was $2.025 USD per gallon, for week of March 29, 2021.

- According to recent testimony from Michael Sloan, Director of Energy Markets for ICF International before the Michigan House Energy Committee, removing Line 5 from the supply chain would boost the cost of propane by 10 to 14 cents over the long-term.

Conclusion

Michigan and Canada have developed strong and valuable energy trade links. The total value of trade flows of energy products between the two jurisdictions was over CA$5.8 billion in 2019 alone. The 1,430 people working in Michigan’s pipeline extraction sector earned an annual mean wage of $81,530 in 2019, about 61 per cent higher than the annual mean wage for all occupations in Michigan. And, the pipeline transportation sector made a contribution of over $643 million to Michigan’s economy in 2019.

Enhancing cross-border transportation infrastructure, most notably moving ahead with new pipeline projects, will be critical to maintaining and strengthening the strong energy product trade ties between Michigan and Canada.

According to the American Petroleum Institute (API),

Continued growth in U.S.-Canada petroleum trade will further strengthen the economies of both countries and further enhance North American energy security. However, such growth in trade relies on the continued development and maintenance of cross-border infrastructure to facilitate the movement of energy commodities and further integration of the North American energy market.

These are important factors to consider in any discussions over the future of Enbridge’s Line 5.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). Image credits: Mackinac Bridge, Mackinaw City by Aaron Burden from Unsplash.com

References (All links live as of May 1, 2021)

American Petroleum Institute (2021), U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits <https://bit.ly/3dHng1A>; Bank of Canada (undated), Currency Converter, December 31, 2019 (date assumed <https://bit.ly/3spjpg0>; Enbridge (undated), The Impact of a Line 5 Shutdown <https://bit.ly/3npPXop>; Enbridge (2021), Line 5 and the Great Lakes Tunnel: Fact vs. Fiction <https://bit.ly/2Pu2ESz>; Mackinac Center for Public Policy (2020), Assessing the Costs of the U.P. Energy Task Force Committee Recommendations <https://bit.ly/3tYjgAB>; Mackinac Center for Public Policy (2020, November 24), “Whitmer Plan to Revoke Line 5 Easement Threatens Reliable, Affordable Energy for Michigan” <https://bit.ly/3npJaea>; Michigan Live (2021), Line 5 closure would hike propane costs, energy consultant testifies, <https://bit.ly/3xyGm3f>.Statistics Canada, International Accounts and Trade Division (2021a), Imports for Specified NAPCS Codes from the United States (Country of Export) by U.S. State of Export, Province of Clearance and Mode of Transport (2019), Custom Tabulation; Statistics Canada International Accounts and Trade Division (2021b), Total Exports for Specified NAPCS Codes to the United States (Country of Destination) by U.S. State of Destination, Province of Origin, Province of Clearance and Mode of Transport (2019), Custom Tabulation; US Bureau of Labor Statistics (2020), Occupational Employment and Wages, May 2019, <https://bit.ly/3nDuWXe>.; U.S. Bureau of Economic Analysis (2021), GDP in Current Dollars by County and MSA [database] <https://bit.ly/3rZKzc6>; U.S. EIA (2020), Michigan State Energy Profile <https://bit.ly/3aKbRxi>. YCharts (2021), Michigan Residential Propane Price <https://bit.ly/3vC7iNQ>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.