To sign up to receive the latest Canadian Energy Centre research to your inbox email: [email protected]

Download the PDF here

Download the charts here

Overview

There has been talk recently that the Canadian oil and gas industry is entering a period of long-term decline and will no longer be in a position as a secure and reliable supplier to a world hungry for energy and pivoting away from Russian oil and gas.

This ignores the most recent production, demand, and investment outlook for oil and gas over the next three decades, as presented by the International Energy Agency (IEA) under its most plausible scenario for climate change policy, known as the Stated Policies Scenario (STEPS).

In this CEC Fact Sheet, we examine projections for oil and natural gas production, demand, and investment, drawn from the IEA World Energy Outlook (WEO), 2022 Extended Dataset, using STEPS. The IEA Extended Dataset provides more detailed data at the global, regional, and country level than that found in the WEO 2022 main report.

Background on IEA World Energy Outlook (WEO) and the Stated Policies Scenario (STEPS)

The IEA released its annual World Energy Outlook in October 2022. The WEO makes uses of a “scenario approach” to examine future energy trends. In WEO 2022, three scenarios are modelled: the Net Zero Emissions by 2050 Scenario (NZE), the Announced Pledges Scenario (APS), and the Stated Policies Scenario (STEPS).

STEPS appears to be the most plausible of the three scenarios set out in 2022 WEO. According to the IEA:

STEPS provides a more conservative benchmark for the future because it does not take for granted that governments will reach all announced goals. Instead, it takes a more granular, sector-by-sector look at what has actually been put in place to reach these and other energy-related objectives, taking account not just of existing policies and measures but also of those that are actually under development (IEA, 2022a).

Key Results

The key results of STEPS, drawn from the IEA Extended Dataset, indicate that the oil and gas industry worldwide, including Canada, is not going into long-term decline over the next three decades.

Oil and natural gas production

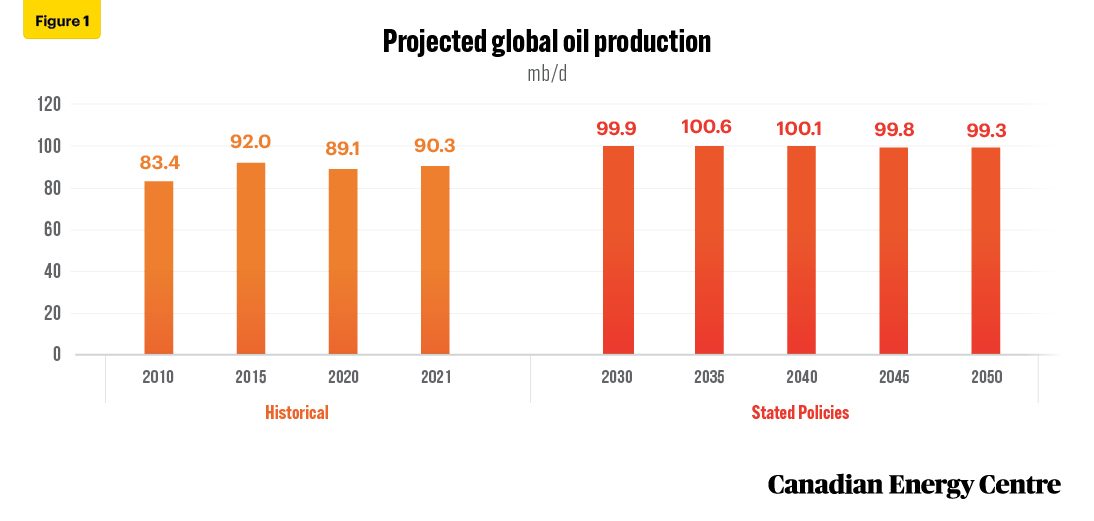

- World oil production is projected to increase from 90.3 million barrels per day (mb/d) in 2021 to 100.6 mb/d in 2035, before falling slightly to 99.3 mb/d in 2050 (see Figure 1).

Source: IEA, 2022(b)

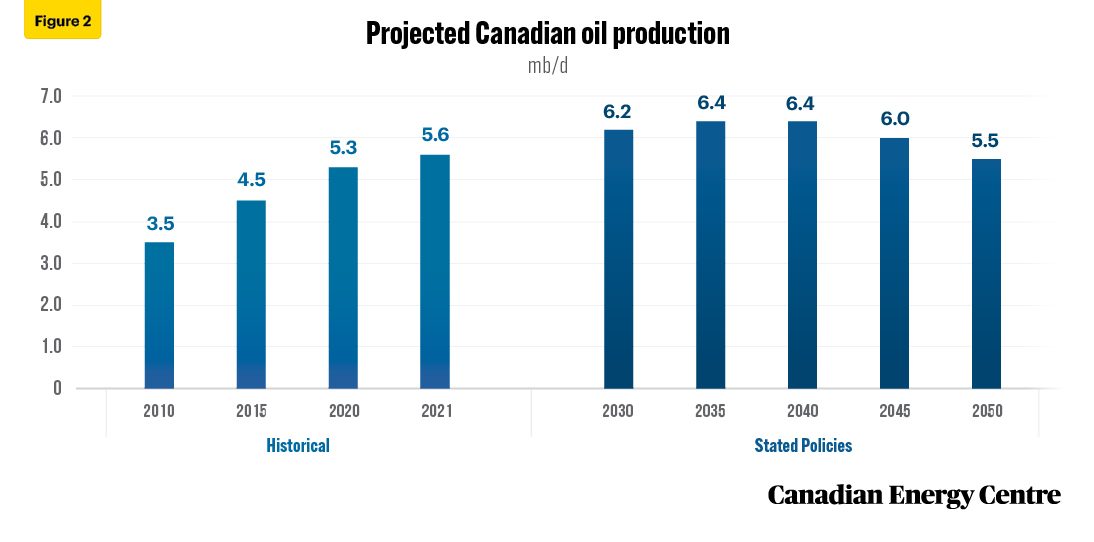

- Canadian oil production is projected to increase from 5.6 mb/d in 2021 to 6.4 mb/d in 2040, before falling back to 5.5 mb/d in 2050 (see Figure 2).

Source: IEA, 2022(b)

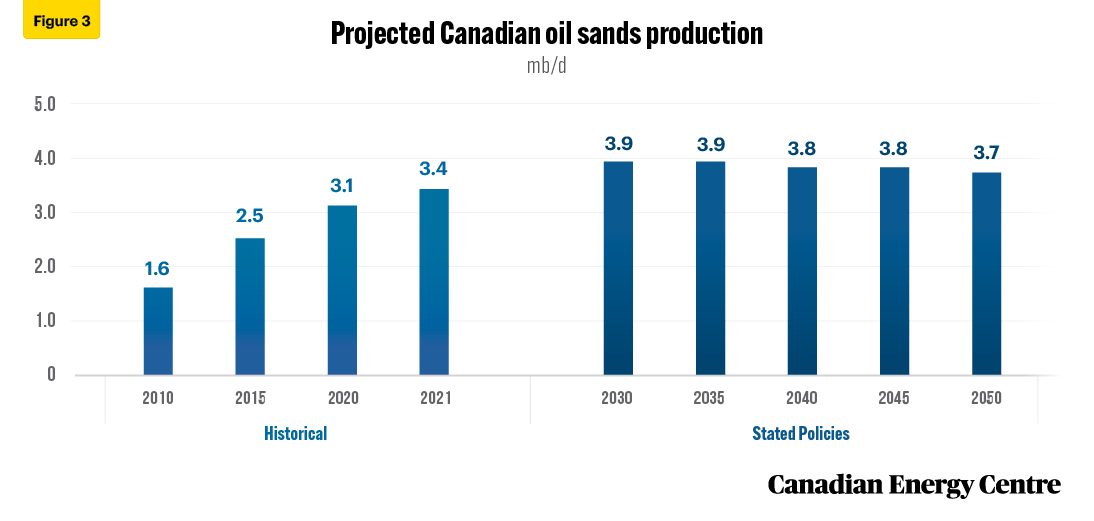

- Canadian oil sands production is projected to increase from 3.4 mb/d in 2021 to 3.9 mb/d in 2035, before falling slightly to 3.7 mb/d in 2050 (see Figure 3).

Source: IEA, 2022(b)

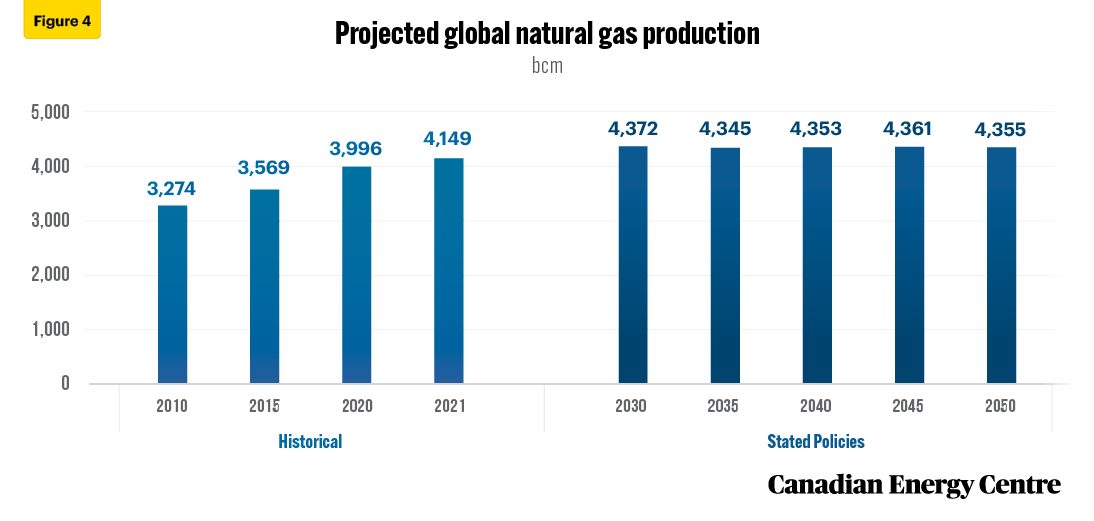

- World natural gas production is projected to increase from 4,149 billion cubic metres (bcm) in 2021 to 4,355 bcm in 2050 (see Figure 4).

Source: IEA, 2022(b)

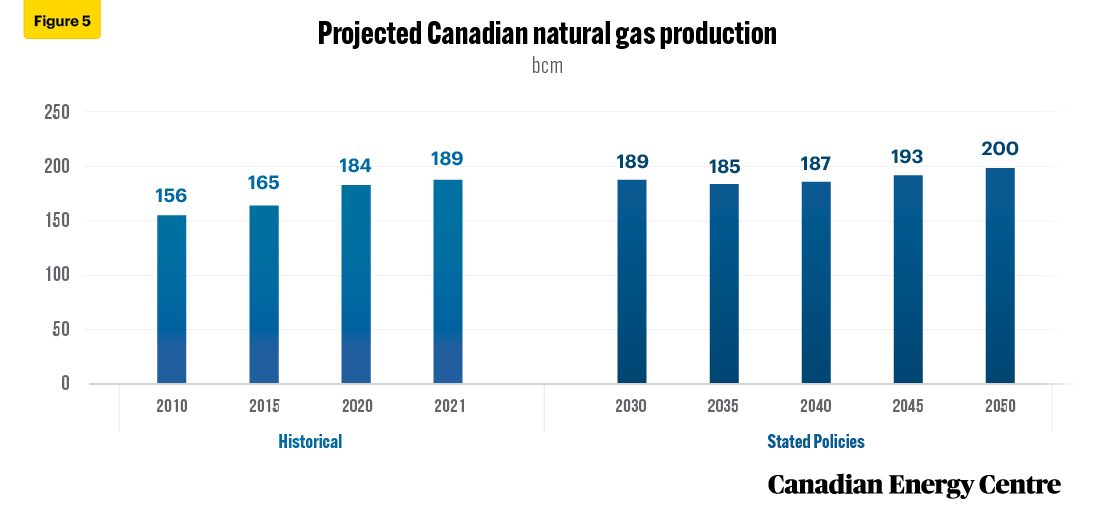

- Canadian natural gas production is projected to increase from 189 bcm in 2021 to 200 bcm in 2050 (see Figure 5).

Source: IEA, 2022(b)

Oil and natural gas demand

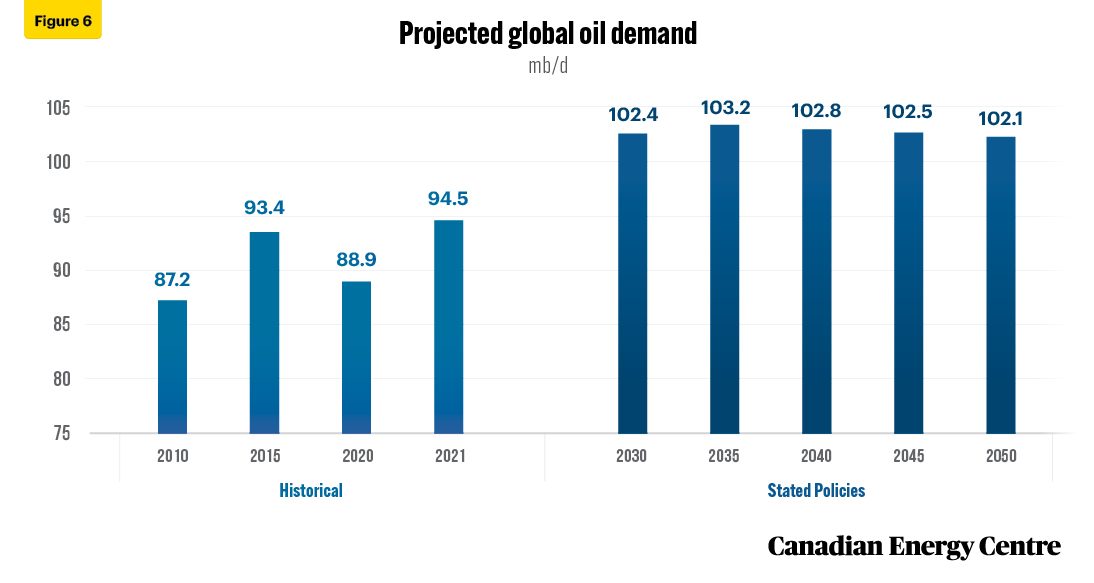

- World demand for oil is projected to increase from 94.5 mb/d in 2021 to 103.2 mb/d in 2035, before falling back slightly to 102.1 mb/d in 2050 (see Figure 6).

Source: IEA, 2022(b)

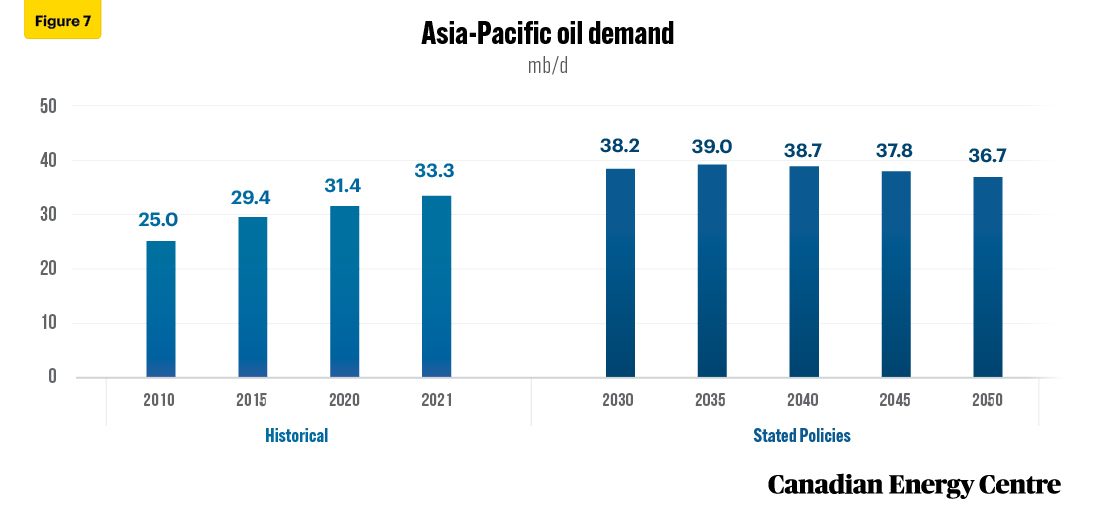

- Asia-Pacific demand for oil is projected to increase from 33.3 mb/d in 2021 to 39 mb/d in 2035, before falling to 36.7 mb/d in 2050 (see Figure 7).

Source: IEA, 2022(b)

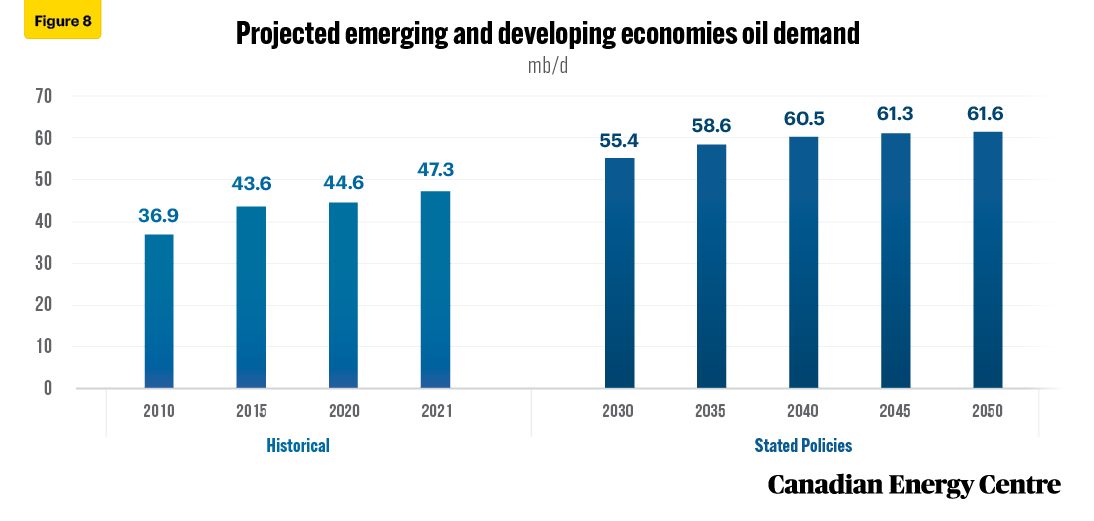

- Emerging and developing economies oil demand is projected to increase from 47.3 mb/d in 2021 to 61.6 mb/d in 2050 (see Figure 8).

Source: IEA, 2022(b)

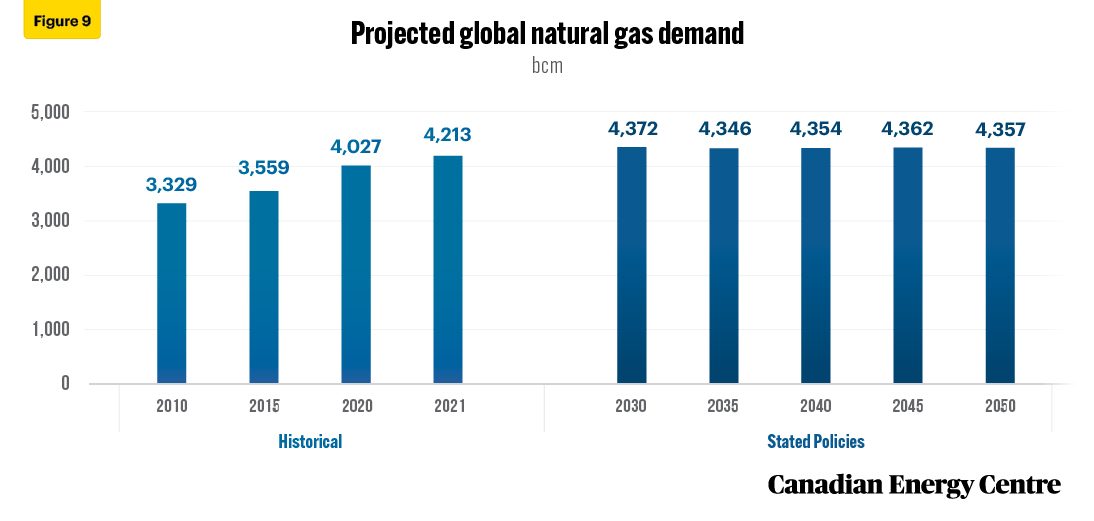

- World demand for natural gas increases from 4,213 bcm in 2021 to 4,357 bcm in 2050 (see Figure 9).

Source: IEA, 2022(b)

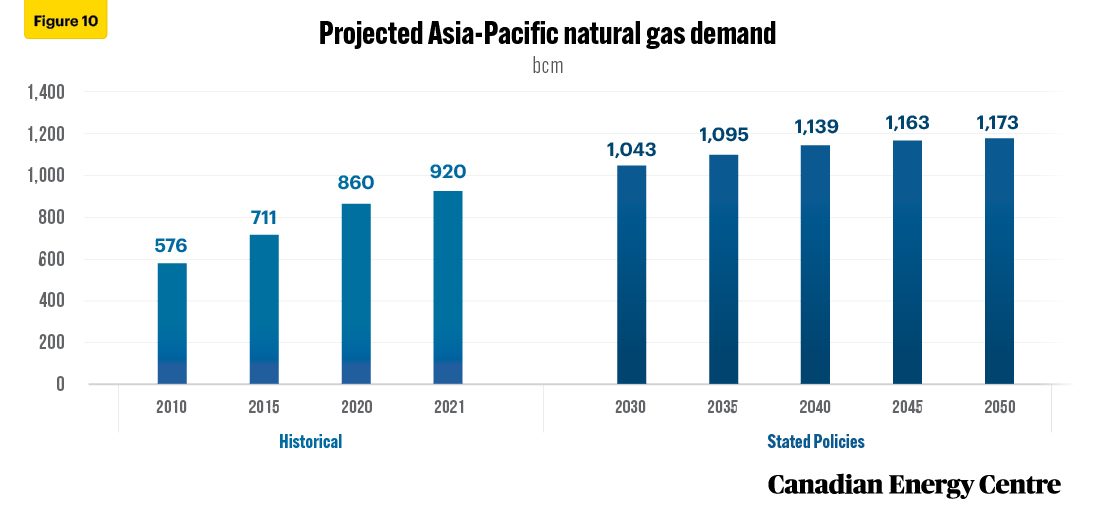

- Asia-Pacific demand for natural gas increases from 920 bcm in 2021 to 1,173 bcm in 2050 (see Figure 10).

Source: IEA, 2022(b)

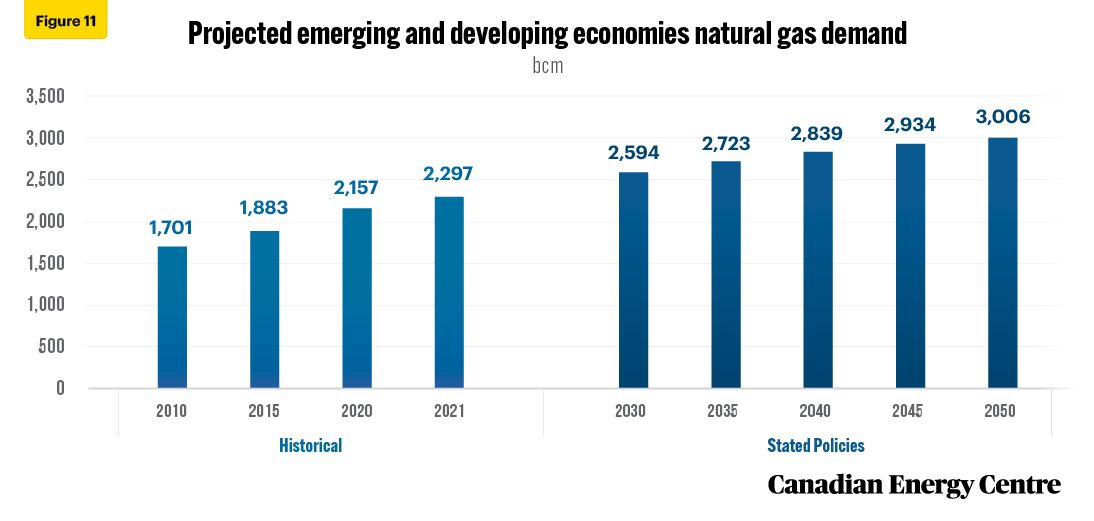

- Emerging and developing economies natural gas demand increases from 2,297 bcm in 2021 to 3,006 bcm in 2050 (see Figure 11).

Source: IEA, 2022(b)

Cumulative investments of over $23 trillion needed to meet global crude oil and natural gas demand through 2050

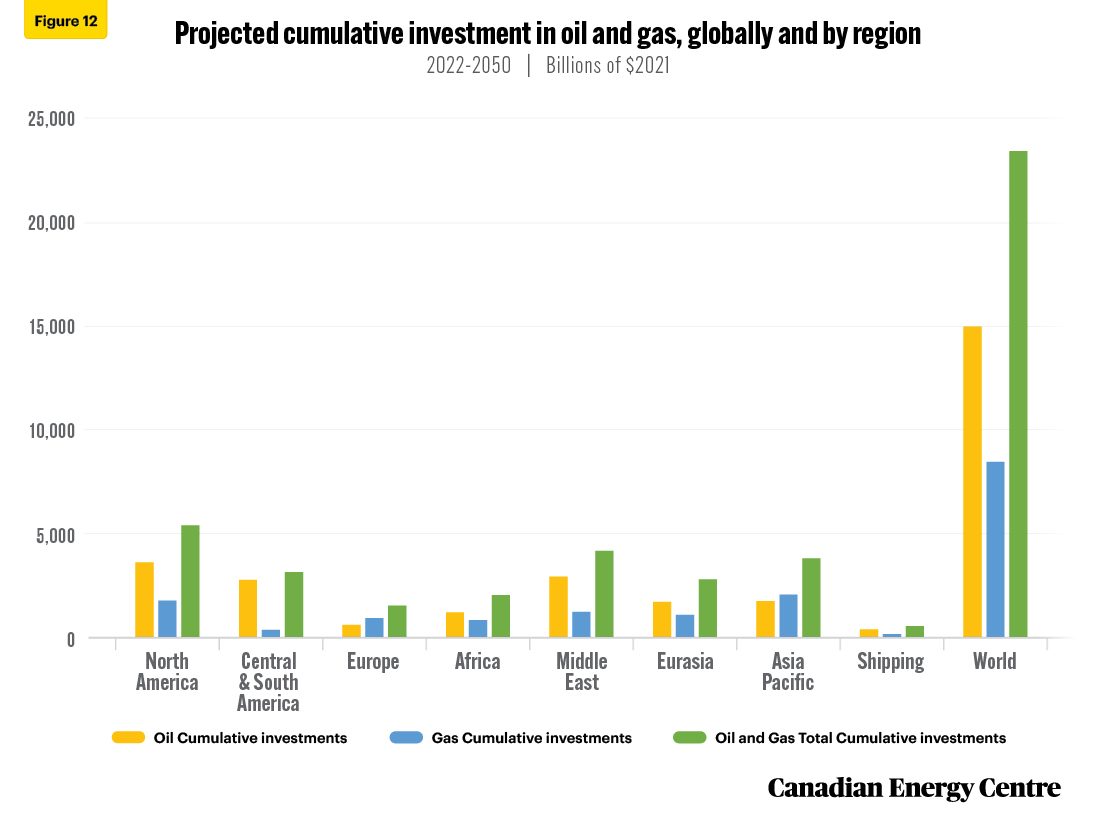

Taking into account projected global demand, between 2022 and 2050, global oil and gas investment (upstream, midstream and downstream) under STEPS is expected to reach nearly $23.4 trillion (in U.S. $2021) cumulative, with global oil investments expected at over $14.9 trillion and natural gas at over $8.4 trillion (see Figure 12).

Total oil and gas investment in North America (Canada, the U.S., and Mexico), between 2022 and 2050, is expected to lead the way at nearly $5.4 trillion, split between oil at over $3.6 trillion and gas at nearly $1.8 trillion (see Figure 12).

Oil and gas investment in the Asia-Pacific, over the same period, is estimated at nearly $3.8 trillion, split between oil at over $1.7 trillion and gas at over $2 trillion (see Figure 12).

Source: IEA, 2022(b)

Global investment trends from IEA STEPS illustrate that the oil and gas industry will remain a strong performer over the next three decades, despite claims by some pundits that the industry is in long-term decline.

With an estimated cumulative investment of over $23 trillion needed to meet global oil and gas demand over the next three decades, Canada is well-positioned to attract a significant slice of that investment pie, assuming it can eliminate current regulatory impediments.

Conclusion

A sector-by-sector look at what measures governments around the world have actually put in place, as well as specific policy initiatives that are under now being development, (i.e., the IEA STEPS scenario), shows that Canadian oil and gas will continue to play a major role in the global economy through 2050.

Key data points on production, demand and investment drawn from the IEA 2022 WEO Extended Dataset confirm this trend.

The IEA data shows that the world needs more Canadian oil and gas.

Positioning Canada as a secure and reliable oil and gas supplier can and must be part of the medium- to long-term solution to meeting the oil and gas demands of the U.S., Europe and other vulnerable nations, as part of a concerted move towards energy security.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and an anonymous reviewer in reviewing the original data and research for this Fact Sheet.

References (all links live as of October 28, 2022)

International Energy Agency (IEA), 2022a. World Energy Outlook. <http://bit.ly/3U6UiLP>; International Energy Agency (IEA), 2022b. World Energy Outlook 2022: Extended Dataset. <http://bit.ly/3Xn286O>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.