The former head of market intelligence at the Toronto Stock Exchange is blasting a recent decision by the New York State Common Retirement Fund to divest its oil sands holdings based on the fund’s goal to be net-zero greenhouse gas emissions by 2040.

Not only is the move hypocritical — given that the fund is divesting $7 million from Canadian oil sands companies while keeping $670 million invested in major hydrocarbon producers ExxonMobil and Chevron — but Gina Pappano says the divestment movement itself hurts Canadians and does nothing to address concerns about climate change.

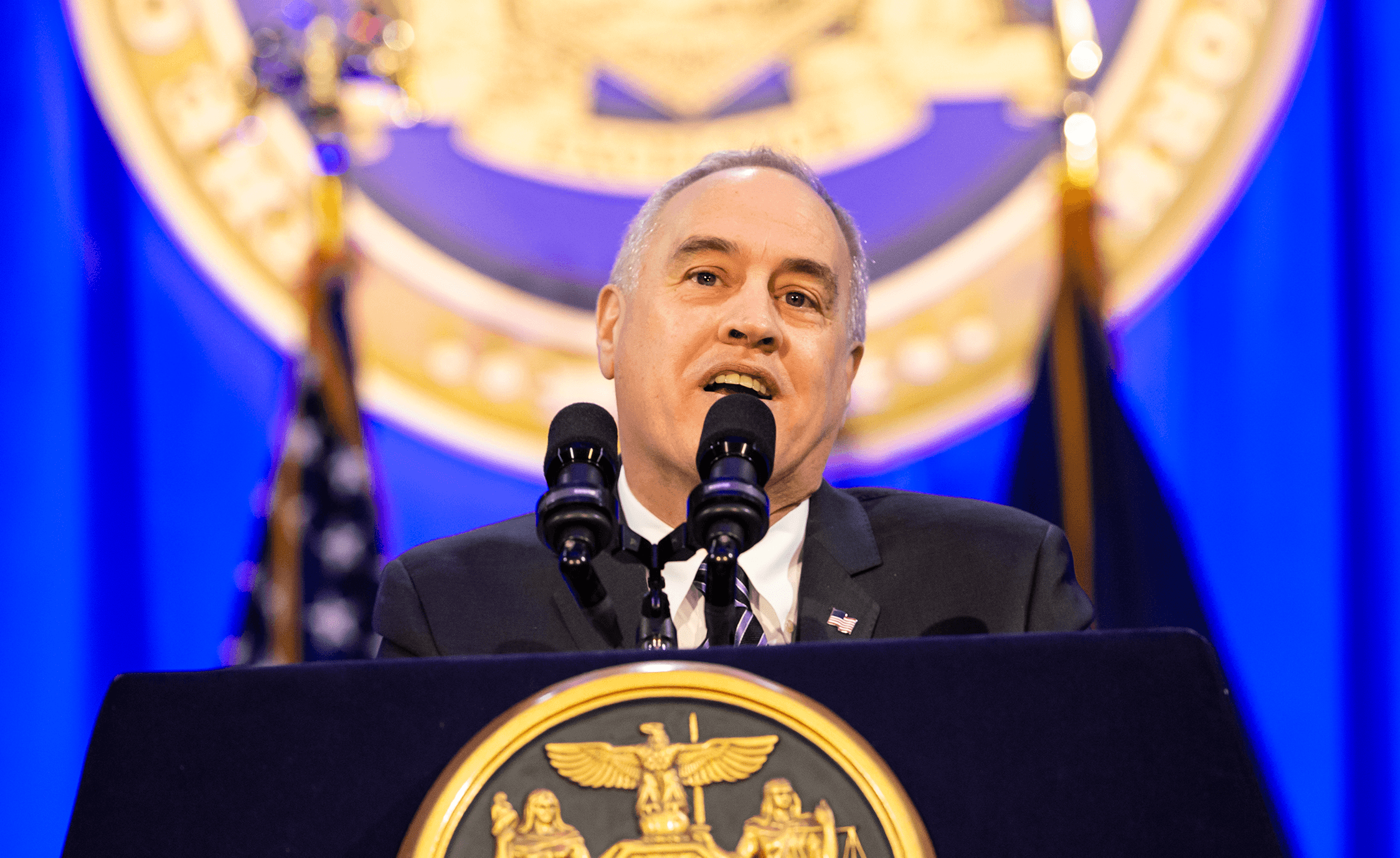

Here’s an open letter from Pappano, Executive Director of InvestNow, to New York State Comptroller Thomas DiNapoli.

—————————————————-

Dear Mr. DiNapoli,

This letter is regarding your recent announcement that the New York State Common Retirement Fund will restrict investments in oil sands companies.

In your own words, “We have carefully reviewed companies in the oil sands industry and are restricting investments in those that do not have viable plans to adapt to the low-carbon future. Companies responsible for large greenhouse gas emissions like those in this industry, pose significant risks for investors.”

Oil sands companies are in the industry that fuels every other industry. Every industry uses energy. A quick review of the Fund’s top holdings by value reveals companies such as Alphabet, Amazon, Facebook, Microsoft, Apple, all huge tech companies that require an abundance of cheap and reliable energy to run their operations.

Further down the list, we see more companies that rely heavily on the hydrocarbon industry to operate, such as Boeing and 3M. And while the Fund is making an example of divesting its approximately $7 million in oil sands holdings, it has made no such announcement regarding its $670 million combined investment in major hydrocarbon companies ExxonMobil and Chevron.

In fact, all the companies in the Fund’s domestic and international equity portfolio are interdependent on the hydrocarbon sector in one way or another.

To eliminate an entire sector from the Fund’s investment portfolio is folly, does not align with the interests of beneficiaries and runs contrary to the fiduciary duty of the Fund.

To use environmental, social and governance (ESG) criteria as the justification is misleading.

Canadian hydrocarbon companies have high environmental standards and are the largest investors in innovation in Canada – leading to ever-improving environmental performance. They provide high paying jobs and contribute a host of other social benefits. On governance, they adhere to the highest measures of transparency and reporting. To restrict investments in these companies is not ESG investing.

The divestment attack on oil sands companies is first and foremost an attack on publicly listed companies. As divestment has no effect on the demand for hydrocarbons, its effect will be to shift the source of supply for that demand.

If the oil and gas that society wants and needs is not provided by Canadian listed private sector companies, it will come increasingly from state-owned suppliers from such countries as Saudi Arabia, the Gulf States, Russia, and Iran. The result will be a market served by companies with low standards on ESG, from countries where serious human rights abuses are common, that are not even remotely approaching the standards of public transparency or accountability to citizens that exist in Canada.

Competitive, transparent markets in free and open societies are the best guarantee for good performance by resources companies, and Canada offers all of this.

The focus of the Fund should be on investment in innovative, transparent companies, not divestment from them. Canadian hydrocarbon companies are investing about three times more than the average firm in emissions reduction technologies. Restricting institutional investment impedes innovation, innovation which could lead to game-changing processes and technologies which is perhaps the biggest risk of all.

Sincerely,

Gina Pappano

Executive Director

InvestNow Inc.