To sign up to receive the latest Canadian Energy Centre research to your inbox email: [email protected]

Download the PDF here

Download the charts here

“Big oil” is mainly “small oil and gas”

There is a general notion that only big companies benefit from development of Canada’s oil and gas sector. But while economies of scale can be of central importance for large oil and gas projects, for producers and suppliers there are advantages to any firm at any size (small and nimble versus large and integrated, for example). In fact, as this Fact Sheet demonstrates, the vast majority of Canada’s oil and gas firms are small businesses. When Canada’s oil and gas sector is healthy, the small businesses therein are de facto able to flourish.

This Fact Sheet profiles oil and gas companies by size (small, medium, large) based on employee counts; it then compares the share of small business by industry; and then by country (Canada and the U.S. and then Norway and the European Union).

Two different types of oil and gas firms are profiled, given available data by jurisdiction.

- The in-Canada oil and gas comparison to other sectors includes oil and gas extraction; support activities for oil and gas extraction; mining and oil and gas field machinery manufacturing; pipeline transportation of crude oil; pipeline transportation of natural gas; and pipeline transportation of refined petroleum products.

- Canadian oil and gas compared to oil and gas sectors in the U.S. and Europe are drawn from a smaller subset of oil and gas activity which allows for international comparisons.

Oil and gas comparisons by firm size

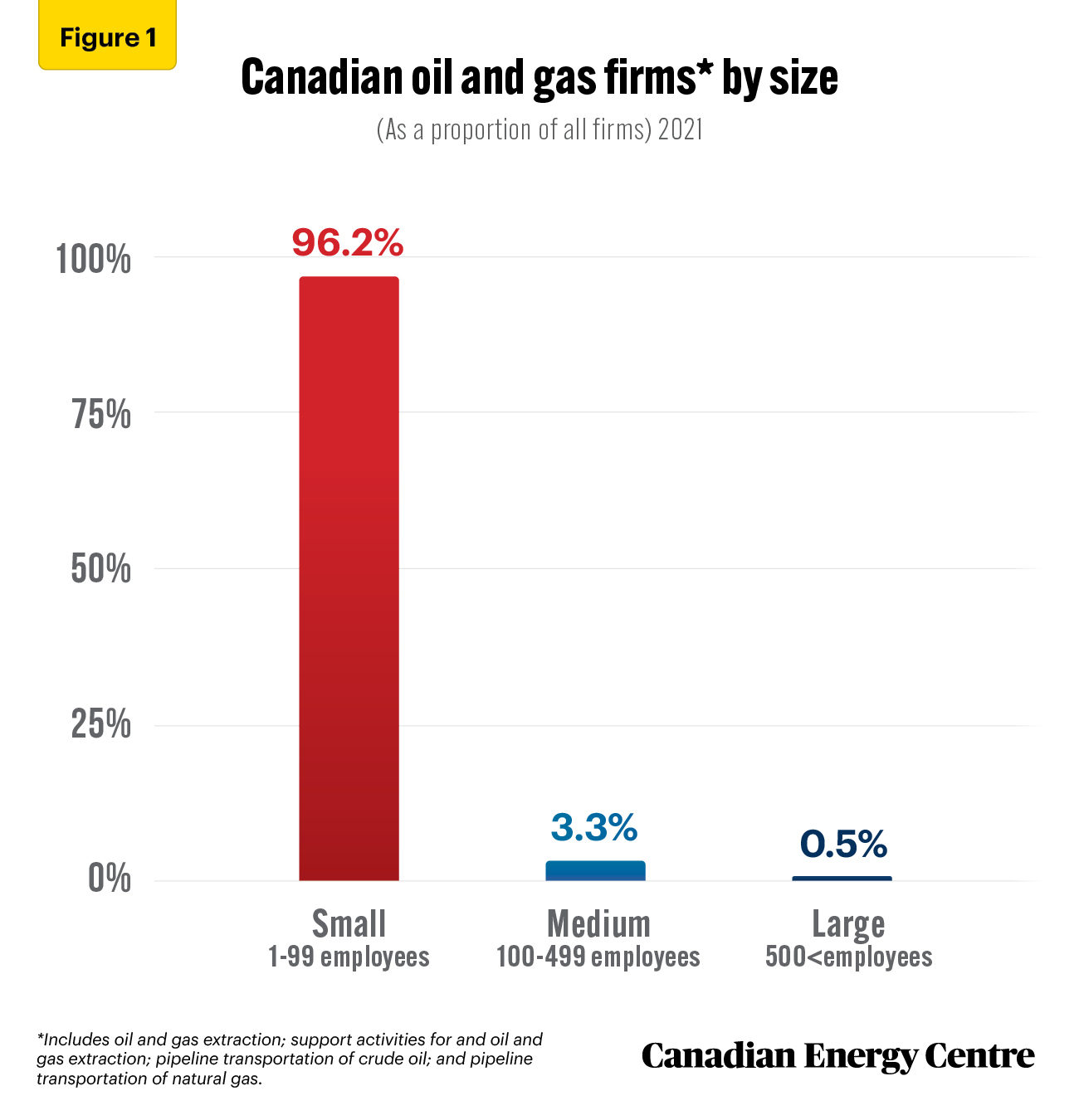

For the purposes of our analysis, small businesses are defined by Statistics Canada as those with between 1 and 99 paid employees. Medium-size enterprises are those with 100 to 499 employees while large enterprises have 500 or more employees. As of 2021, for oil and gas firms in Canada:

- 96.2 per cent are small. i.e., companies with between one and 99 employees;

- 3.3 per cent are medium-size companies, with between 100 and 499 employees; and

- 0.5 per cent are large companies with 500 or more employees (see Figure 1).

Source: Author’s calculations based on Statistics Canada Table 33-10-0493-01.

Industry comparisons in Canada

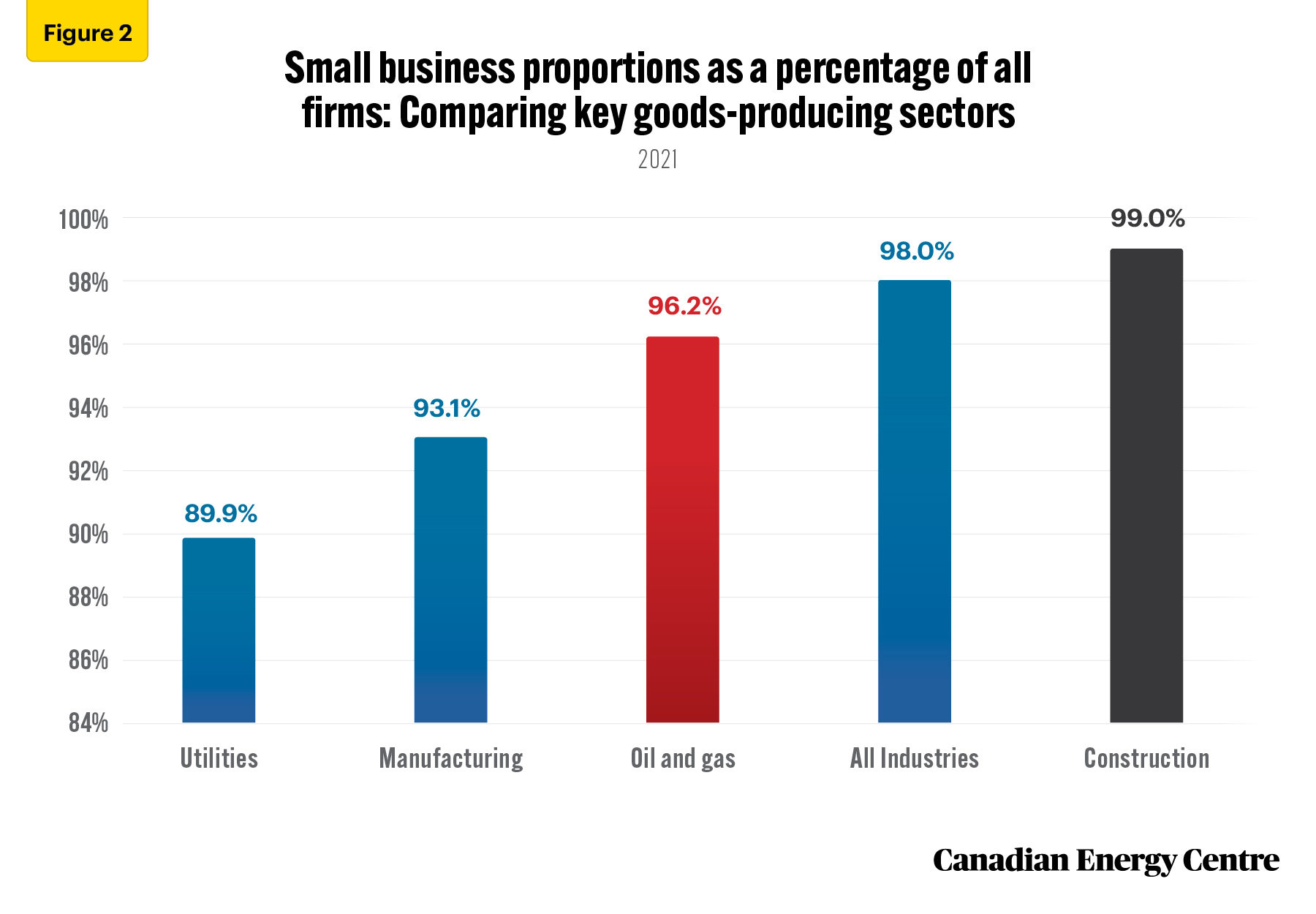

In Canada, the energy sector has a higher proportion of small businesses than other major industries, with the exception of construction (see Figure 2). As of 2021, 96.2 per cent of all energy firms have employee counts between 1 and 99 compared with 93.1 per cent in manufacturing, 89.9 per cent in utilities, and 99 per cent in the construction sector. The all-industry average is 98 per cent.¹

1. The 98 per cent average for all industries is high in large measure because of the sheer size of the construction sector. In 2021, there were 148,840 firms in that sector compared with 50,596 in manufacturing, 6,833 in oil and gas, and 1,422 in utilities.

Source: Authors’ calculation based on Statistics Canada Table 33-10-0493-01.

Canada-U.S. comparisons on oil and gas sector company size by employee count

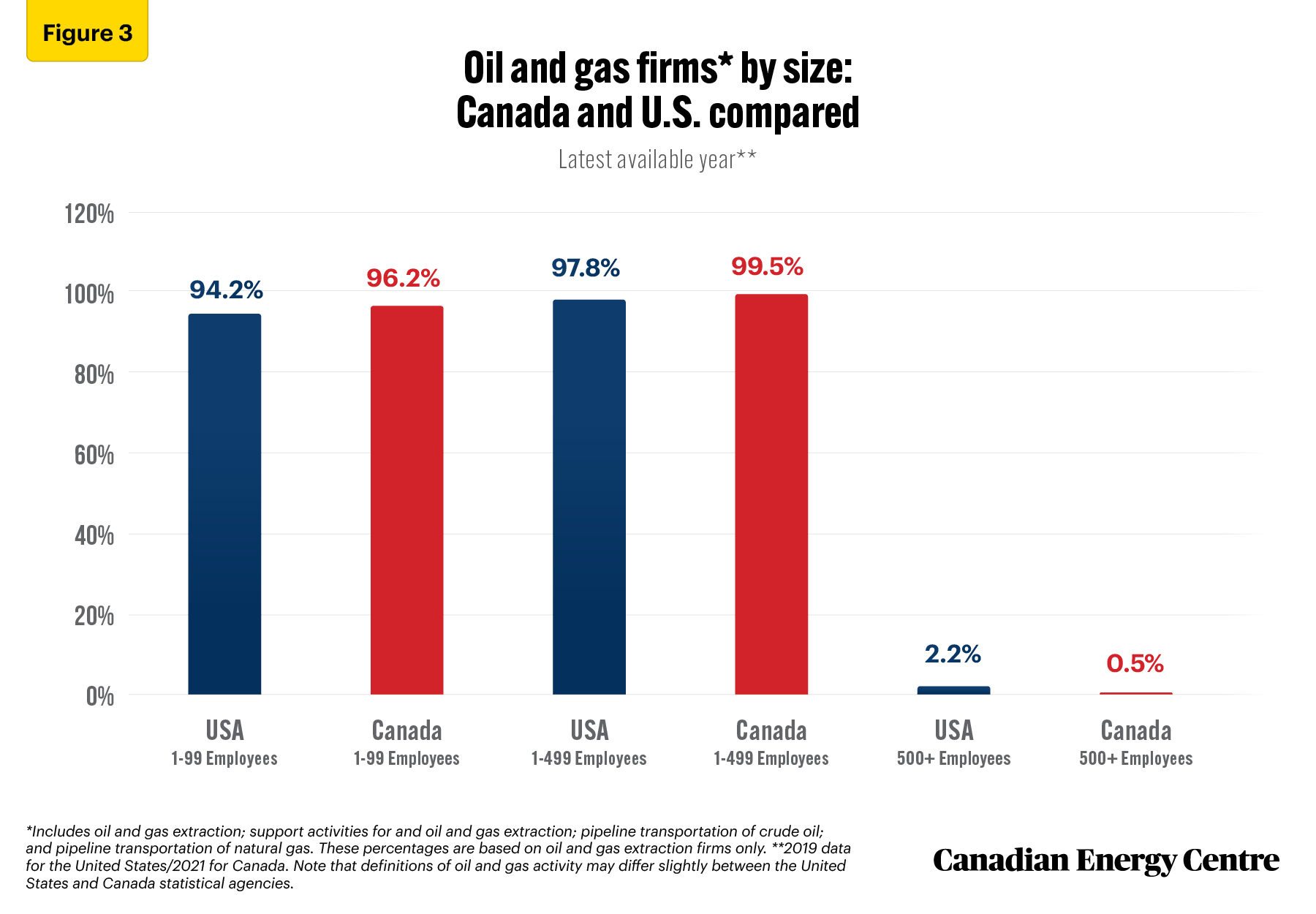

Canada and the United States define small businesses differently, with an employee count of 1-99 in Canada and 1-499 employees in the United States.

For a more standardized comparison between the two countries, Figure 3 shows both the 1-99 employee comparison and the 1-499 comparison. Using Canadian definitions of firm size:

- Small business comparisons: 94.2 per cent of all oil and gas firms in the United States have employee counts between 1 and 99 employees compared with 96.2 per cent in Canada.

- Small and medium-size business comparisons Adding in medium-size employee counts (defined in Canada as 100 to 499 employees), we find that 97.8 per cent of all oil and gas firms in the United States have employee counts between 1 and 499 employees (i.e., are small and medium size using Canadian definitions) compared with 99.5 per cent in Canada.

- “Big oil and gas”: Corporations with 500-plus employees in the United States thus represent 2.2 per cent of all oil and gas firms while in Canada the figure for “big oil and gas” is just 0.5 per cent of all firms (see Figure 3).

Sources: Derived from Statistics Canada Table 33-10-0493-01 and U.S. Small Business Administration.

Canada-Europe comparisons: Total firms involved in oil and gas

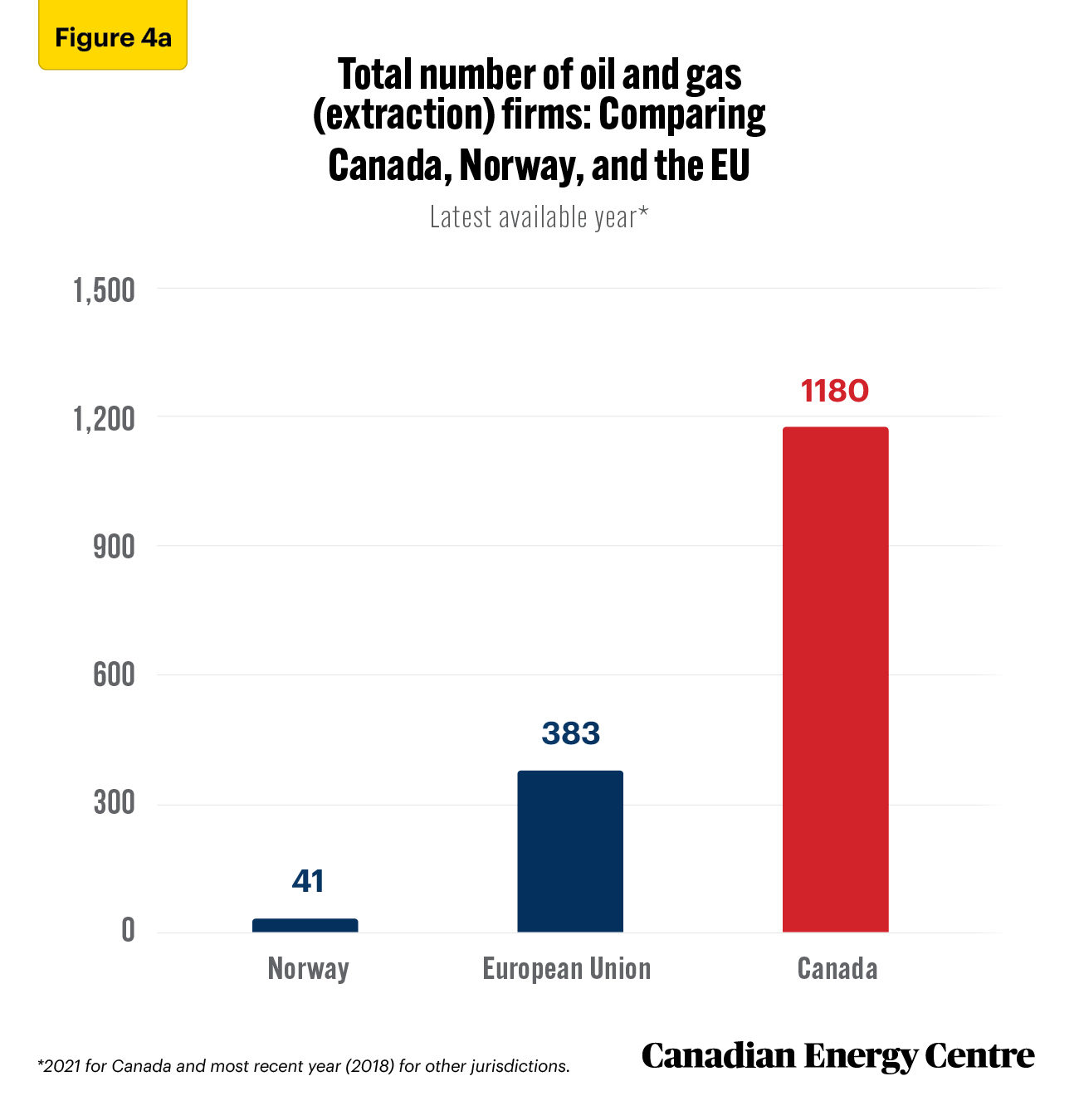

The final set of comparisons contrast Canada with Norway (another major oil producer) and the European Union (of which Norway is not a member) . The first comparison (Figure 4a) makes obvious the importance of the oil and gas sector to Canada given the sheer number of oil and gas firms.²

- Far and away, Canada has the largest number of oil and gas extraction firms — small, medium, and large — at 1,180 in total.

- In contrast, Norway has just 41 oil and gas extraction firms and the European Union has just 383 firms in total involved in oil and natural gas activity.³

2. Canada-Europe comparisons are drawn from a smaller subset of oil and gas activity—oil and gas extraction only—which allows for international comparisons. 3. Large firms dominate Norway’s oil and gas sector given all of its oil and gas results from offshore drilling, which is complicated and expensive.

Source: Eurostat and Statistics Canada.

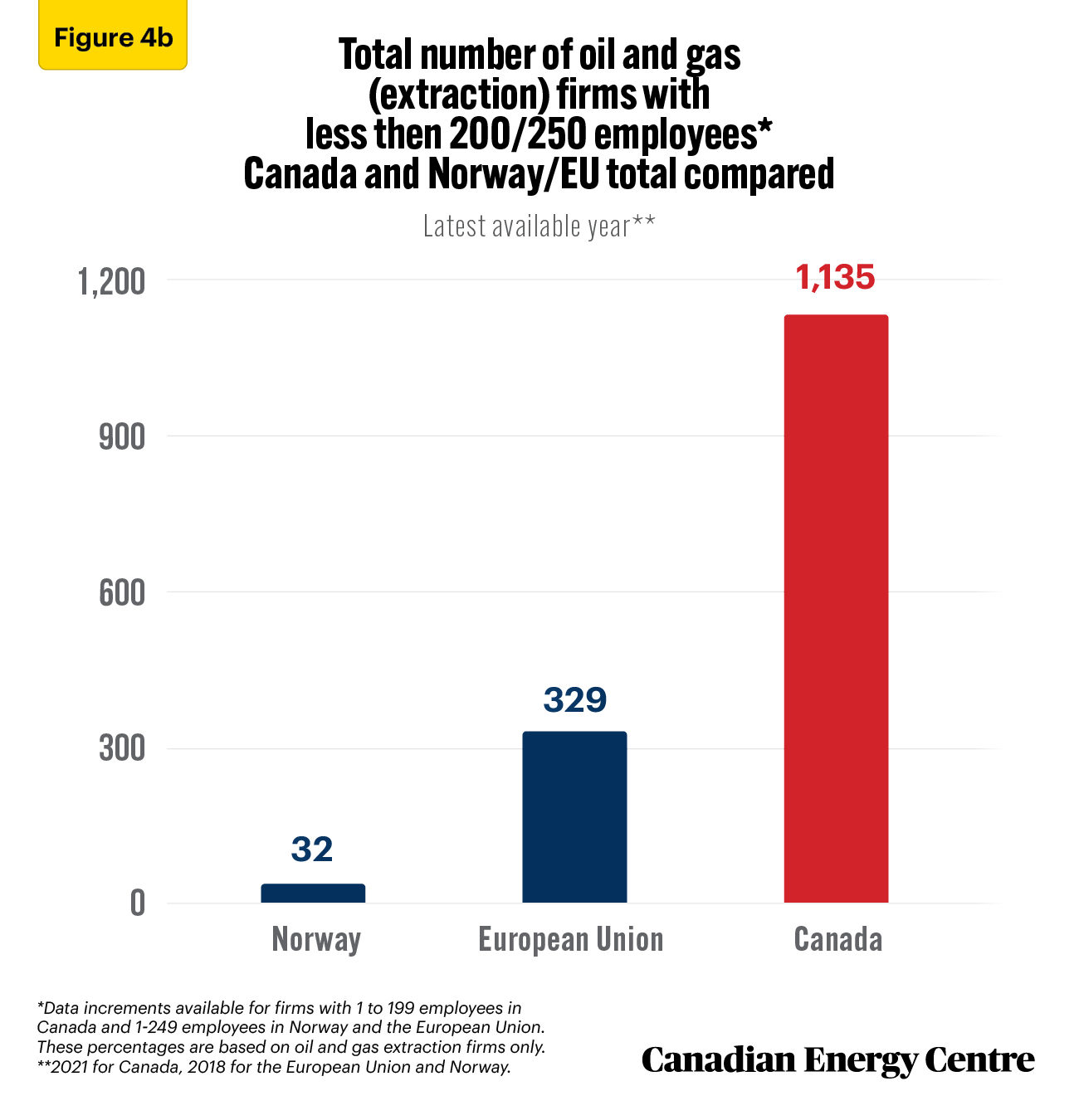

Canada compared with Europe and Norway on smaller companies

Unlike Canada-U.S. comparisons, data limitations do not allow for exact 1-99 or 1-499 employee count comparisons on firm sizes between Canada and Norway and the European Union. However, we can compare Canada (1-199 employees, i.e., below 200) with Norway and Europe (1-249 employees, i.e., below 250). Figure 4b breaks down the proportion of oil and gas extraction firms by size for each jurisdiction.

- Norway has just 32 oil and gas extraction firms with fewer than 250 employees;

- The European Union has 329 firms that employ fewer than 250 employees; and

- Canada has 1,135 oil and gas extraction firms with fewer than 200 employees. In other words, even with a more limited comparison available for Canada, the absolute number of oil and gas companies with smaller workforces is about three times that of Norway and the European Union combined (1,135 firms versus 361 oil and gas enterprises in Norway and the EU together).

Source: Eurostat and Statistics Canada.

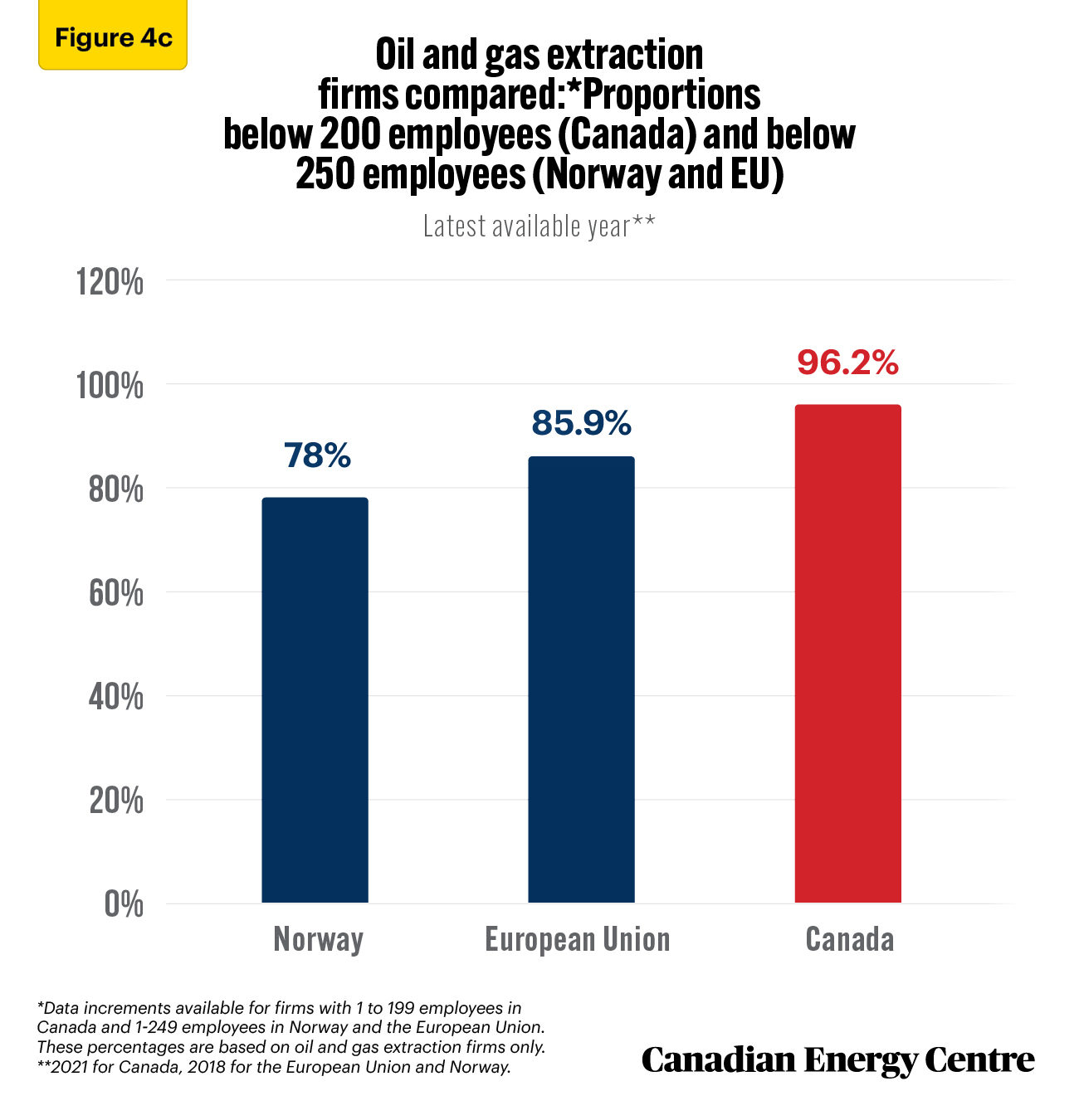

“Big oil” is a more accurate description in Europe, not Canada

This slightly modified comparison shows that smaller businesses constitute just 78 per cent of all oil and gas extraction firms in Norway, 85.9 per cent of all firms in the European Union, and 96.2 per cent of all and gas extraction firms in Canada. Canada’s oil and gas extraction sector is thus overwhelmingly composed of small and medium-size businesses relative to Norway and the European Union (see Figure 4c).

Source: Eurostat and Statistics Canada.

Conclusion

Most oil and gas firms in Canada are small or medium-size businesses whether measured domestically and compared with other sectors, or in comparison to the United States, Norway and in the European Union.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Lennie Kaplan at the Canadian Energy Centre: www.canadianenergycentre.ca. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and an anonymous reviewer for reviewing the data and research for this Fact Sheet. Image credits: Government of Alberta

References (All links live as of March 22, 2022)

Canada (2021). Key Small Business Statistics-2021 <https://bit.ly/3N2rq50>; European Union (undated). European Union—About Member Countries. <https://bit.ly/3eu9Nsw>; Eurostat (undated) <https://bit.ly/2DGOLtN>; Statistics Canada (2021). Table 33-10-0493-01, Canadian Business Counts, with employees, December 2021. <https://bit.ly/36ezrmV>; U.S. Small Business Administration (2020). 2020 Small Business Profile <https://bit.ly/3N6bEpQ>; United States Census (2022). 2019 SUSB Annual Data Tables by Establishment Industry <https://bit.ly/3CYEOm2>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.