To sign up to receive the latest Canadian Energy Centre research to your inbox email: [email protected]

Download the PDF here

Download the charts here

Energy facts

In its May 2021 report, the International Energy Agency asserted that no new investment in oil and natural gas exploration is required. However, this call for a dramatic end to oil and natural gas exploration — and then production and consumption — must be placed in some context. As the report itself points out, at present 700 million people in the world do not have access to electricity and 2.6 billion people do not have access to energy to cook a meal. Thus, given that billions of people are without basic electricity and other forms of energy to meet their everyday needs, the world needs more investment in the energy sector, not less.

However, with an emphasis on investment in new forms of energy sources, including from the IEA, many policymakers often overlook core realties including whether transitional forms of energy are technologically feasible at present and, if not, what the results of drastic actions to curb fossil fuels would mean in practice.

Energy density facts

To grasp why this matters, consider one of the world’s leading experts on energy transitions, University of Manitoba professor of the environment (emeritus) Vaclav Smil, who in his book, Energy, describes what energy is: “By far, the most common definition of energy is ‘the capacity for doing work.’” Smil then notes that the full implication of this seemingly simple statement “becomes clear only when you go beyond thinking about work as mechanical exertion—in physics terms, energy transferred through application of force over a distance, in common terms a labor to be performed….” In other words, before abandoning something as a source of energy, we must consider how little (or much) of that source it takes to produce the outcomes we need.

On the issue of technological feasibility, Smil has also noted that “the reality of energy density in various forms of energy sources (be they oil, natural gas, coal, wind, solar and others) must be accounted for as part of any assumed transition.” In 2018, Science magazine cited Smil’s point that energy transitions are normally transitions away from “relatively weak, unwieldy energy sources for those that pack a more concentrated punch.” Instead, what we’re seeing in current attempts to transition away from fossil fuels does the opposite, or as Smil also remarked in 2018, trying to reverse that practical attention to energy density by moving to all-renewable sources of energy could require countries to, in the paraphrase of his words from Science, “devote 100 or even 1000 times more land area to energy production than today… [which] could have enormous negative impacts on agriculture, biodiversity, and environmental quality.”

Similarly, as Smil wrote for the University of Saskatchewan’s Johnson Shoyama School of Public Policy in 2020, “Designing hypothetical roadmaps outlining complete elimination of fossil carbon from the global energy supply by 2050 is nothing but an exercise in wishful thinking that ignores fundamental physical realities.”¹

1. Recently, in a similar vein, in May 2021, America’s climate envoy John Kerry made a similar observation, noting that the technology doesn’t exist to support net-zero emission targets by 2050.

The IEA report and selected countries

Oil and gas play an important role in maintaining our existing quality of life. Perhaps most critically, key energy-using countries around the world such as Japan have signalled implicitly or explicitly that they will not agree to the IEA’s call to stop oil and gas investment. Consider three major oil-consuming nations in Asia and relevant facts including one explicit statement, one implicit action, and a forecast.

- Japan’s Ministry of Economy has noted that Japan does not plan to stop oil, natural gas, and coal investment: “Japan needs to protect its energy security including a stable supply of electricity, so we will balance this with our goal of becoming carbon neutral by 2050.”

- China’s demand for oil and natural gas is set to increase in the coming decades and is not yet near peak oil demand. Moreover, one state owned Chinese company alone is forecast to spend US$37 billion in capital expenditures in 2021.

- In India, the demand for oil is forecast to grow at a compounded annual growth rate of 4.2 per cent from the base year of 2017 and extending to 2040.

Worldwide energy sources: key facts

If statements, actions and forecasts in key countries such as Japan, India, and China and realities about energy density call into question the ability or desire of countries to simply end oil and natural gas exploration, extraction, and consumption, then the question of which countries are more likely to engage in oil and gas exploration in the future is relevant. Expressed differently, if investment now directed to Canada’s oil and gas sector (or America’s, for that matter) ends, which countries are more likely to produce oil and gas in the future?

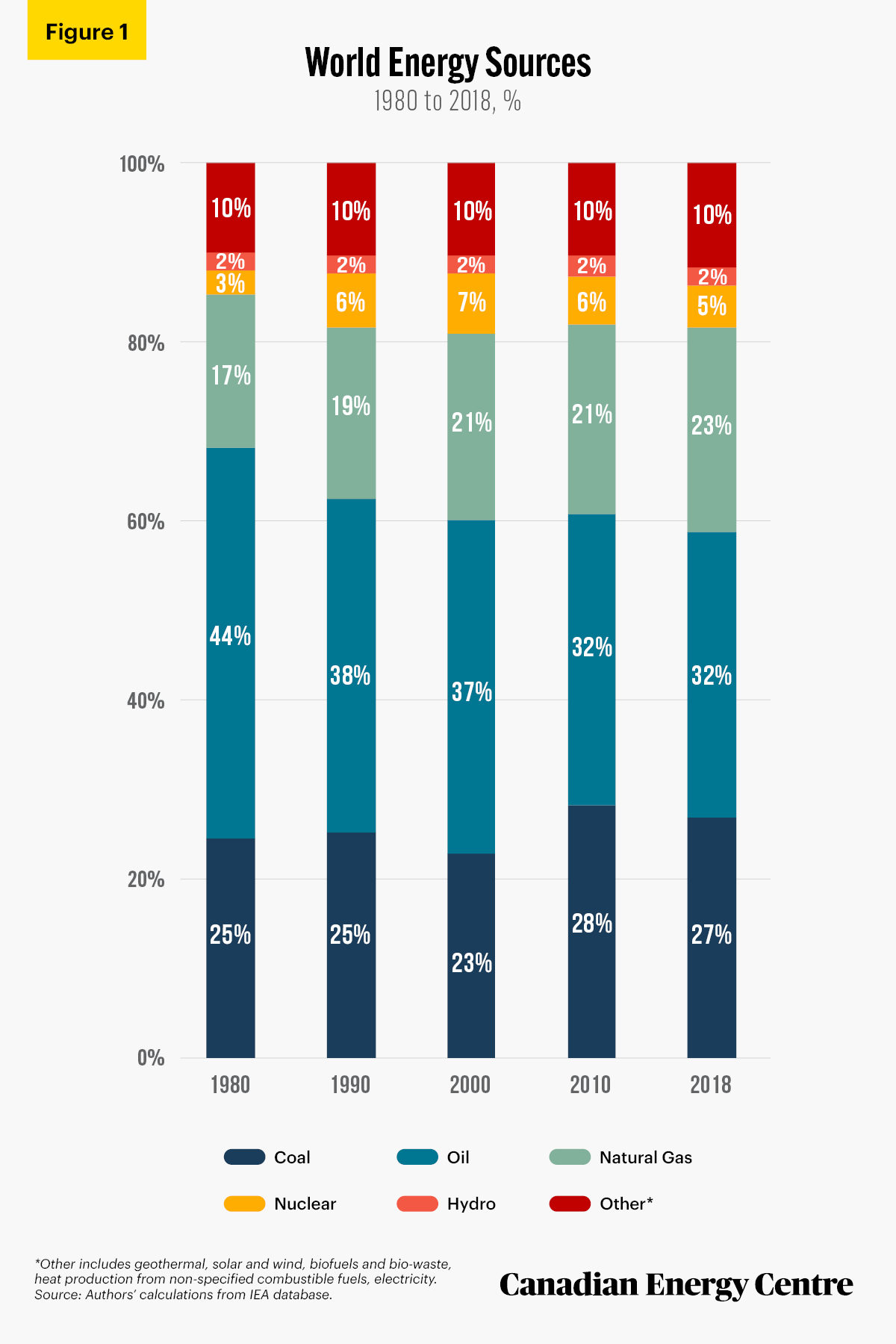

To put this matter in further perspective, consider first that oil and natural gas still compose a significant proportion of the world’s energy supply. In 2018, those two energy sources constituted 55 per cent of the world’s energy supply, down slightly from 61 per cent in 1980 (see Figure 1). As Vaclav Smil has made clear, energy transitions take considerable time to transpire—multiples of decades—and thus no one can assume that the demand for and consumption of oil and natural gas will necessarily decline faster in the next 40 years than has been the case in the most recent four decades—even in response to the IEA’s “hypothetical roadmaps,” to use Smil’s language.

Source: Authors’ calculations from IEA database.

Oil reserves worldwide: Key facts

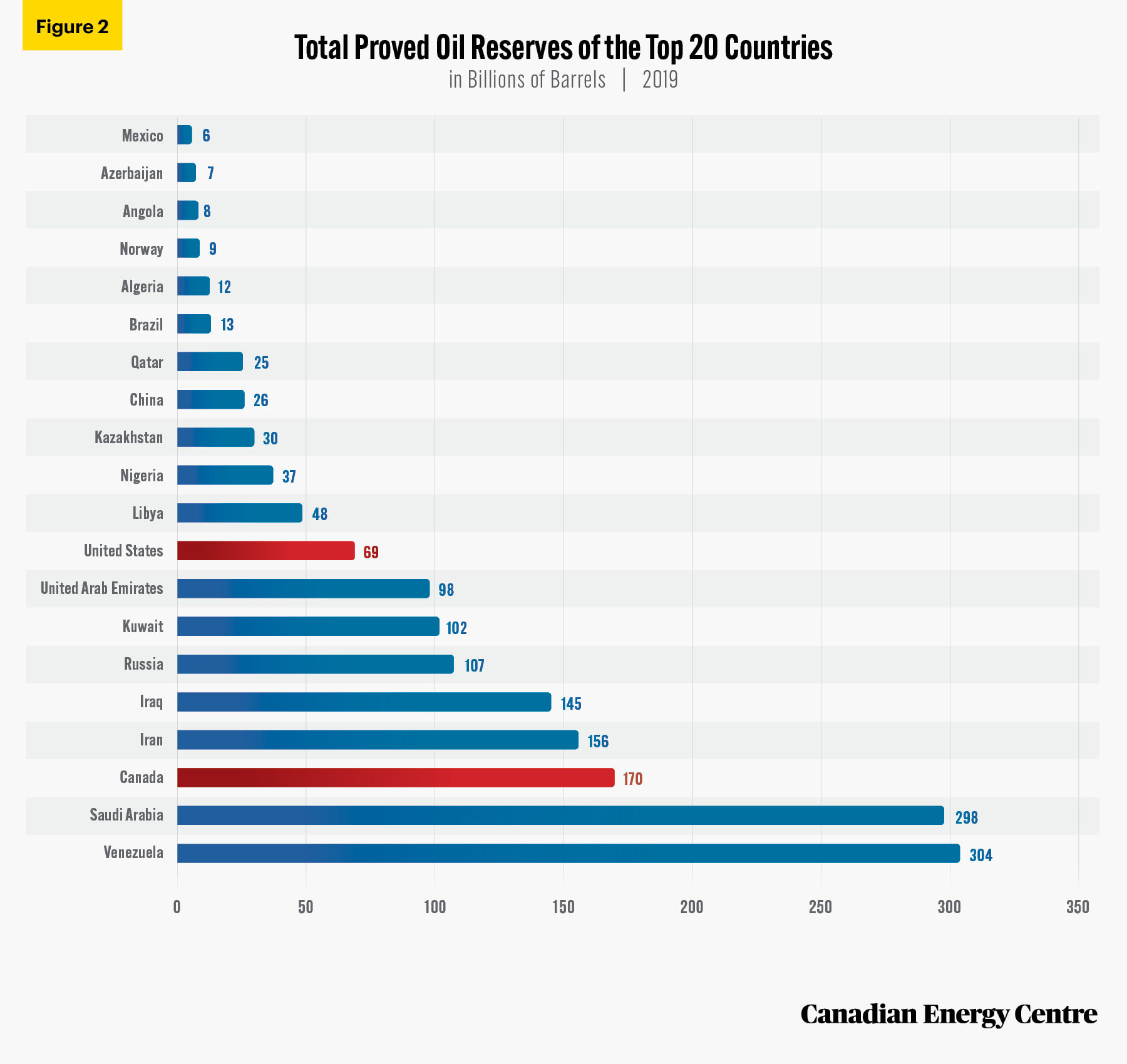

Turning to oil only, consider the countries most able to increase production if firms in Canada and the United States are pressured to curtail their oil production (either directly, or indirectly, if they find their investment or insurance coverage have been withdrawn). To see clearly which nations have the capability to undertake future oil and gas exploration, we will outline total proved reserves worldwide. We first profile reserves by billions of barrels and then by years of production left, looking at the countries with the top 20 proved oil reserves, and then years of reserves left at current production rates.

First, consider total proved reserves in billions of barrels (see Figure 2). Canada has the world’s third largest proved oil reserves at 170 billion barrels, behind only Saudi Arabia (298 billion barrels) and Venezuela (304 billion barrels). If in future decades oil exploration and extraction in the United States and Canada decline significantly due to pressure from investors, insurers, and others, and yet if oil demand still exists, there are many other countries with significant reserves that can extract, produce, and export oil. Among the current top 10 countries with proved oil reserves, apart from Canada and the United States, the other eight are Libya, the United Arab Emirates, Kuwait, Russia, Iraq, Iran, Saudi Arabia, and Venezuela. The combined proved oil reserves of these eight countries equals 1.257 trillion barrels.

Source: BP Statistical Review (2020).

Years left of production in the top 20 countries

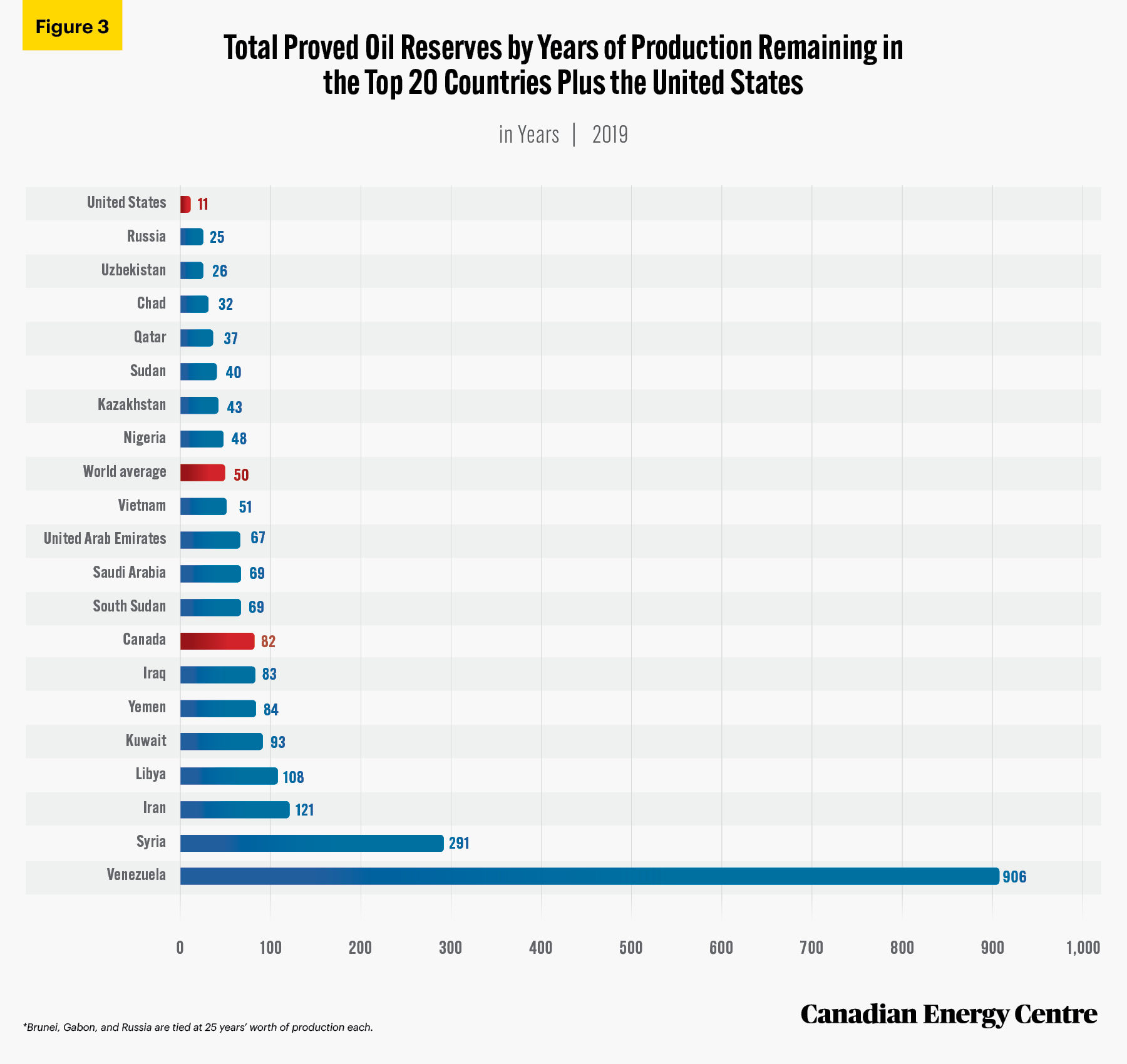

Second, consider total proved reserves measured by total years remaining for existing known reserves. On average, the world reserve-to-production (R/P) ratio shows that oilreserves in 2019 could be counted on to last 50 years given production.² Again, we show the top 20 countries (see Figure 3). We have also added the United States for comparative purposes though it is not among the top 20. Among just the top 20 countries, Russia has 25 years’ worth of proved oil reserves remaining while Venezuela has 906 years. The other 18 countries are between that range.³

If we assume that oil exploration and extraction in Canada and the United States winds down, among just the top 10 countries nine may still choose to encourage production from their reserves. Those nine include the Saudi Arabia, South Sudan, Iraq, Yemen, Kuwait, Libya, Iran, Syria, and Venezuela.

2. Global oil reserves are estimated by calculating the reserve-to-production ratio (R/P). The resulting value represents the number of years of oil reserves remaining at the current rate of usage. 3. Venezuela’s oil production has plummeted due to that country’s political problems, which have both scared away investment and left Venezuela’s state-owned oil firm with a lack of capital and talent to extract much oil at present.

Source: BP Statistical Review (2020).

Reserves by region

Now consider oil reserves by region in billions of barrels and by years of production remaining.

- The Middle East has 834 billion barrels of proved oil reserves with 74 years left of production;

- South and Central America have proved oil reserves of 324 billion barrels and 144 years of production left;

- Africa has 125 billion barrels of oil in proved reserves and 41 years’ worth of production;

- North America’s proved oil reserves are 244 billion barrels and 27 years of production remaining (Canada has 170 billion barrels and 82 years; the United States has 69 billion barrels and 11 years; and Mexico at just under 6 billion barrels of proved oil reserves has eight years of production left);

- The Commonwealth of Independent States (CIS) countries including Russia have 146 billion barrels of proved oil reserves and 27 years’ worth of production remaining;

- • Europe’s oil reserves are just 14 billion barrels with 12 years of production left.

Worldwide investments in oil and natural gas (upstream)

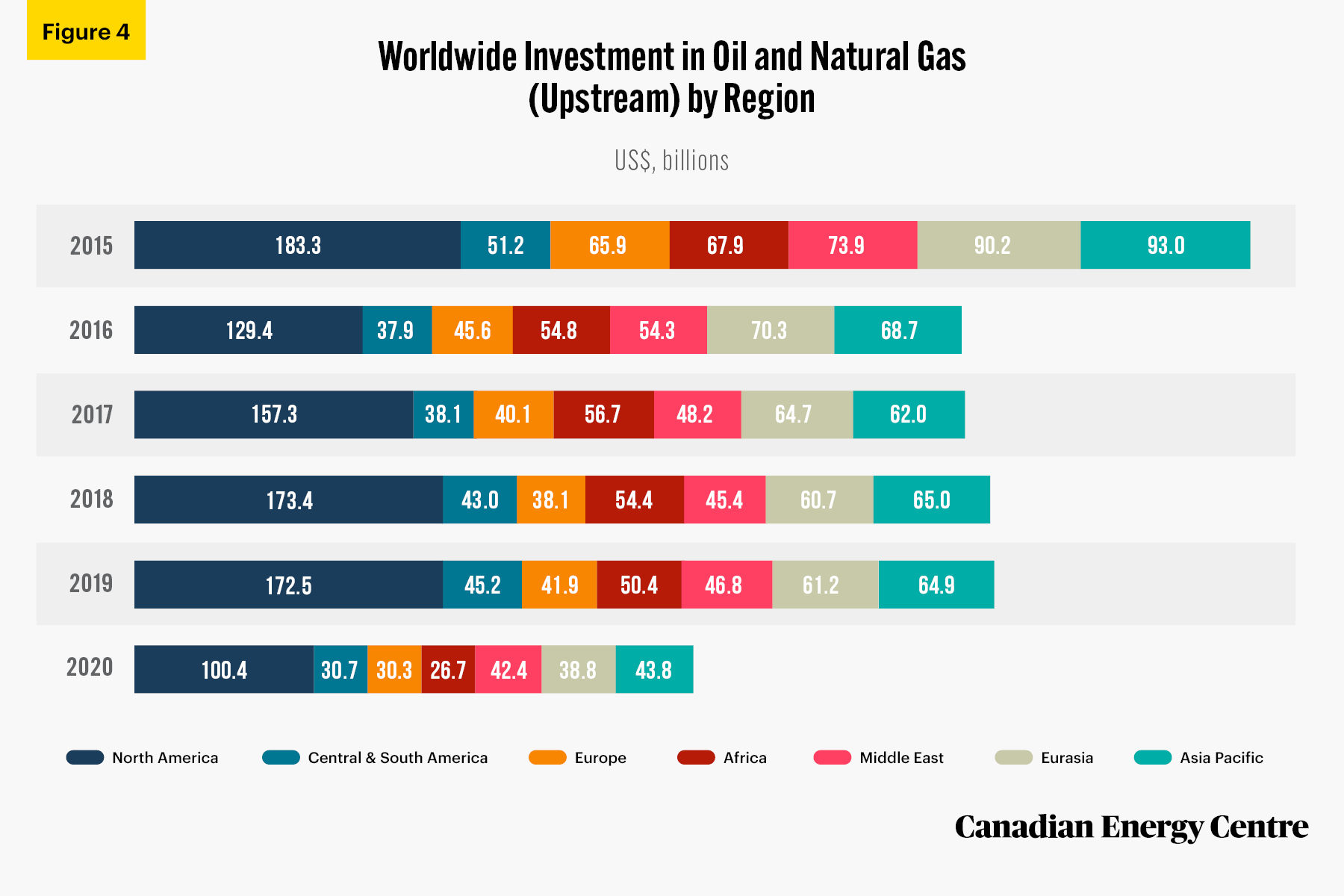

Worldwide investment in oil and natural gas (upstream) has declined from US$625 billion in 2015 to US$313 billion as of 2020 (see Figure 4). Africa has seen investment fall from US$67 billion to US$26 billion in 2020. In North America, investment fell by 45 per cent from US$183 billion in 2015 to US$100 billion in 2020.

Part of the decline in 2020 can be explained by Covid-related slackening of demand and the difficulty of starting major projects that year. However, if the trend continues and paired with the “power punch” that oil and natural gas possess compared with other fuels, the lack of investment and the depletion of oil and natural gas reserves could hamper supplies and lead to more people facing a lack of access to basic energy that is both inexpensive and possesses sufficient density to accomplish even minor — much less major — tasks.

Source: IEA (2020), World Energy Investment.

Observations and conclusion

Vaclav Smil has noted that assumed transitions away from fossil fuels will be impossible any time soon given energy density realities. Even U.S. climate envoy John Kerry has recognized that such a transition will be challenging. Governments in Canada and the United States may choose, via policy, to ignore the technological challenges and make extraction of oil and gas difficult in future years. However, they cannot assume that oil and natural gas demand and consumption will necessarily decline faster in the next 40 years than they have in the most recent four decades. Moreover, if the demand for oil specifically is stronger than the hypothetical scenarios indicate it will be, other nations with significant proved oil reserves could quite readily fill any production gaps deliberately engineered by policymakers in North America.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). Percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader-friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using source data. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and an anonymous reviewer in reviewing the data and research for this Fact Sheet. Image credits: Anatoly Stafichick from Pexels.com

References (All links live as of May 28, 2021)

BBC (May 16, 2021), John Kerry: US Climate Envoy Criticised for Optimism on Clean Tech <https://bbc.in/3oq1Rz9>; BP (2020), Statistical Review of World Energy 2020 (69th edition) <https://on.bp.com/3s1sHhZ>; Bloomberg (February 9, 2021), China Needs to Hit Peak Oil Long Before It Reaches Net-Zero Emissions <https://bloom.bg/344fz15>; IEA (2020), World Energy Investment 2020 <https://bit.ly/346KQ3m>; IEA (2021a), IEA World Energy Statistics (database) <https://bit.ly/34nYWOF>; IEA (2021c), Net Zero by 20250 <https://bit.ly/3f68wve>; Invest India (n.d.), Snapshot: World’s Fastest-Growing Energy Market <https://bit.ly/3hLjrw2>; Dan Murtaugh and Krystal Chia (March 25, 2021), The Oil Industry’s Biggest Spending Driller Is Now in China, Bloomberg <https://bit.ly/3wiIk6e>; Sonali Paul and Yuka Obyashi (May 20, 2021), Asia Snubs IEA’s Call to Stop New Fossil Fuel Investments, Globe and Mail <https://tgam.ca/3ueXrMR>; Vaclav Smil (2017), Energy: A Beginner’s Guide, 2nd Edition, London: One World; Vaclav Smil (2020), What We Need to Know about the Pace of Decarbonization, Johnson Shoyama Graduate School of Public Policy, University of Saskatchewan, <https://bit.ly/3c02HO7>; Paul Voosen (March 21, 2018), Meet Vaclav Smil, the Man Who Has Quietly Shaped How the World Thinks about Energy,” Science <https://bit.ly/3f5eTPl>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.