As Canada’s oil and gas industry faces the uncertainty of a looming emissions cap and a “Just Transition,” billions of dollars of investment is underway in other countries to grow oil and gas supply for the future.

Here’s just a handful of examples.

Afghanistan – Amu Darya basin

US$690 million

Xinjiang Central Asia Petroleum and Gas Co.

Afghan Deputy PM Mullah Abdul Ghani Baradar at a news conference in Kabul announcing an oil development agreement with Xinjiang Central Asia Petroleum and Gas Co. Photo: Twitter/Zabihullah Mujahid

In January, Chinese state-owned Xinjiang Central Asia Petroleum and Gas Co. signed a deal with the Taliban-controlled Afghanistan government to invest nearly US$700 million over four years on oil development in the country’s north.

The 25-year contract also involves building Afghanistan’s first oil refinery.

The Taliban militant group returned to power in Afghanistan after the withdrawal of U.S. forces in 2021. Its ownership share of the oil project will gradually rise to 75 per cent, according to spokesman Zabihullah Mujahid.

The Taliban maintains close ties with the terrorist group al-Qaeda, according to the Council on Foreign Relations (CFR). Since resuming its rule in Afghanistan, authorities have resumed public floggings and executions, violently cracked down on protesters and activists, “obliterated” women’s rights, and “enforced prohibitions on behavior deemed un-Islamic,” the CFR says.

Brazil – Santos Basin

TotalEnergies

US$1 billion

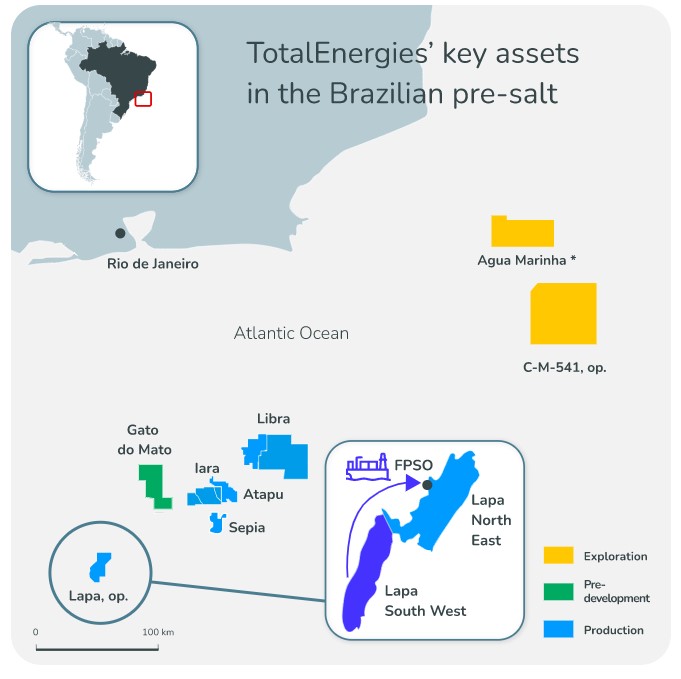

France-based TotalEnergies announced in January it will go ahead with a US$1 billion expansion of oil production offshore Brazil.

The development is located about 300 kilometres off the coast in the Santos Basin. TotalEnergies, which has operated in Brazil for more than 40 years, is 45 per cent owner along with partners Shell, Repsol and Sinopec.

The project will consist of three new deepwater wells connected to an existing floating production and storage vessel. It is expected to increase production to 60,000 barrels per day in 2025, up from about 35,000 barrels per day today.

Norway – Norwegian Continental Shelf

Aker BP

US$29 billion

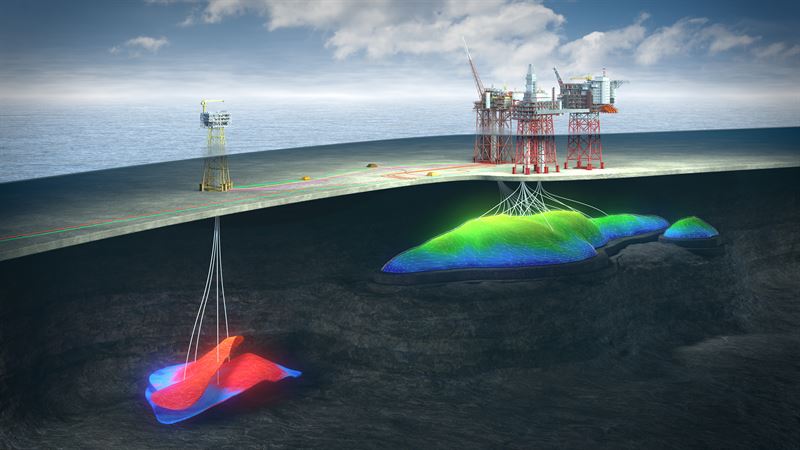

Oslo, Norway-based Aker BP and its partners filed formal plans in December for four offshore oil and gas projects on the Norwegian Continental Shelf.

A total investment of nearly US$30 billion, the developments are expected to increase Aker BP’s oil and gas production to around 525,000 barrels per day in 2028, compared to 400,000 in 2022.

The company’s strategy is to meet the world’s growing need for energy while simultaneously contributing to reducing emissions, said CEO Karl Johnny Hersvik.

The projects are enabled by a 2020 government stimulus package that “allowed oil companies to embark upon new commitments,” he said.

Qatar – North Field East LNG expansion

Qatar Energy

US$29 billion

Qatar’s Minister of State for Energy Affairs and QatarEnergy CEO Saad Sherida al-Kaabi (R) and TotalEnergies CEO Patrick Pouyanne announce partnership in the giant North Field East LNG project at the QatarEnergy headquarters in Doha on June 12, 2022. Getty Images photo

One of the world’s largest LNG exporters is expanding its capacity with the largest LNG project ever built.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year. Startup is expected in late 2024.

A planned second phase of the project will further increase capacity to 126 million tonnes per year. QatarEnergy’s partners include Shell, TotalEnergies, Exxon Mobil, ConocoPhillips and Eni.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Russia – Vostok Oil

Rosneft

US$170 billion

Russian President Vladimir Putin and executives with state oil company Rosneft present a major shipbuilding complex to Indian Prime Minister Narendra Modi. India will be an investor in a new US$170 billion oil project in the Russian Arctic. Photograph courtesy Rosneft

Despite the war in Ukraine and wide-ranging energy sanctions, Russian state-owned oil company Rosneft says work continues to advance on schedule for the massive Vostok oil project.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase.

Rosneft reports that as of mid-2022, more than 1,000 units of special construction equipment are in operation, as well as seven new Russian arctic class drilling rigs, with another five on the way. Over 4,000 people and 2,000 vehicles have been mobilized.

“This means that the project lives and develops as planned, the inevitable difficulties are being overcome, but we have full confidence that all the tasks will be completed,” Rosneft CEO Igor Sechin said.

“In the context of decreasing investment in the oil and gas sector, Vostok Oil is the only project in the world capable to provide a stabilizing effect on the hydrocarbon markets.”

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.